As we step into the second quarter of 2024, let’s take a closer look at the trends shaping the Manhattan real estate landscape. Our most recent 1st Quarter 2024 market report shares insights into the recent performance of our current market.

Pricing Trends

The data from Q1 initially reflects a continued decline in Manhattan’s real estate prices. The median sale price dropped 3.7% compared to last year, settling at $1,059,000. Similarly, the median price per square foot saw an 8.3% decrease to $1,130 over the same period. However, when considering more real-time metrics, there are indications that the market may have reached a turning point. The slowdown in sales volume, which began with rising interest rates in the second quarter of 2022, may have bottomed out towards the end of last year. The uptick in activity observed earlier this year hints at a gradual improvement in market sentiment.

Time on the Market

One notable shift is the increase in the average time properties spend on the market, rising by 35% from the previous quarter to 113 days. However, when adjusted for seasonal variations, the yearly increase was a more modest 2.7%. This rise in time on the market, alongside declining prices, suggests that while buyers remain active, they are also adopting a more patient approach.

Sales to List Ratio

Properties in Manhattan sold at 94% of their original asking price during Q1, a figure largely unchanged from previous periods. This stability in the sales-to-list ratio suggests that the market may have already experienced its lowest point.

End of March 2024 Data

Taking a closer look at the data through the end of March 2024, we observe several key developments:

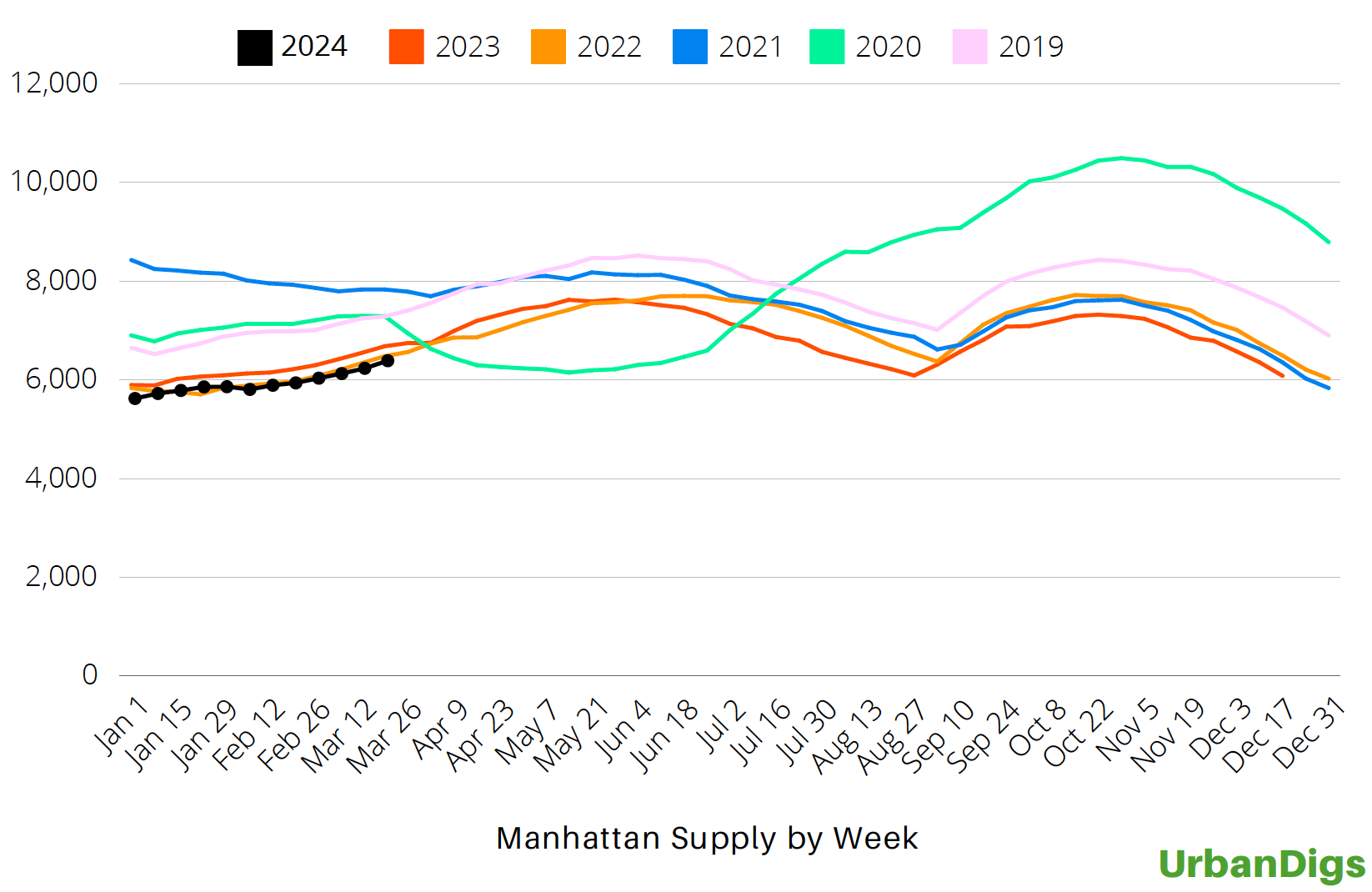

Manhattan’s supply increased by 2.5% remaining solidly on trend. New listings saw a 4.5% increase in just one week, contributing to overall listing activity nearing the 4,000 mark year to date.

Supply

www.urbandigs.com

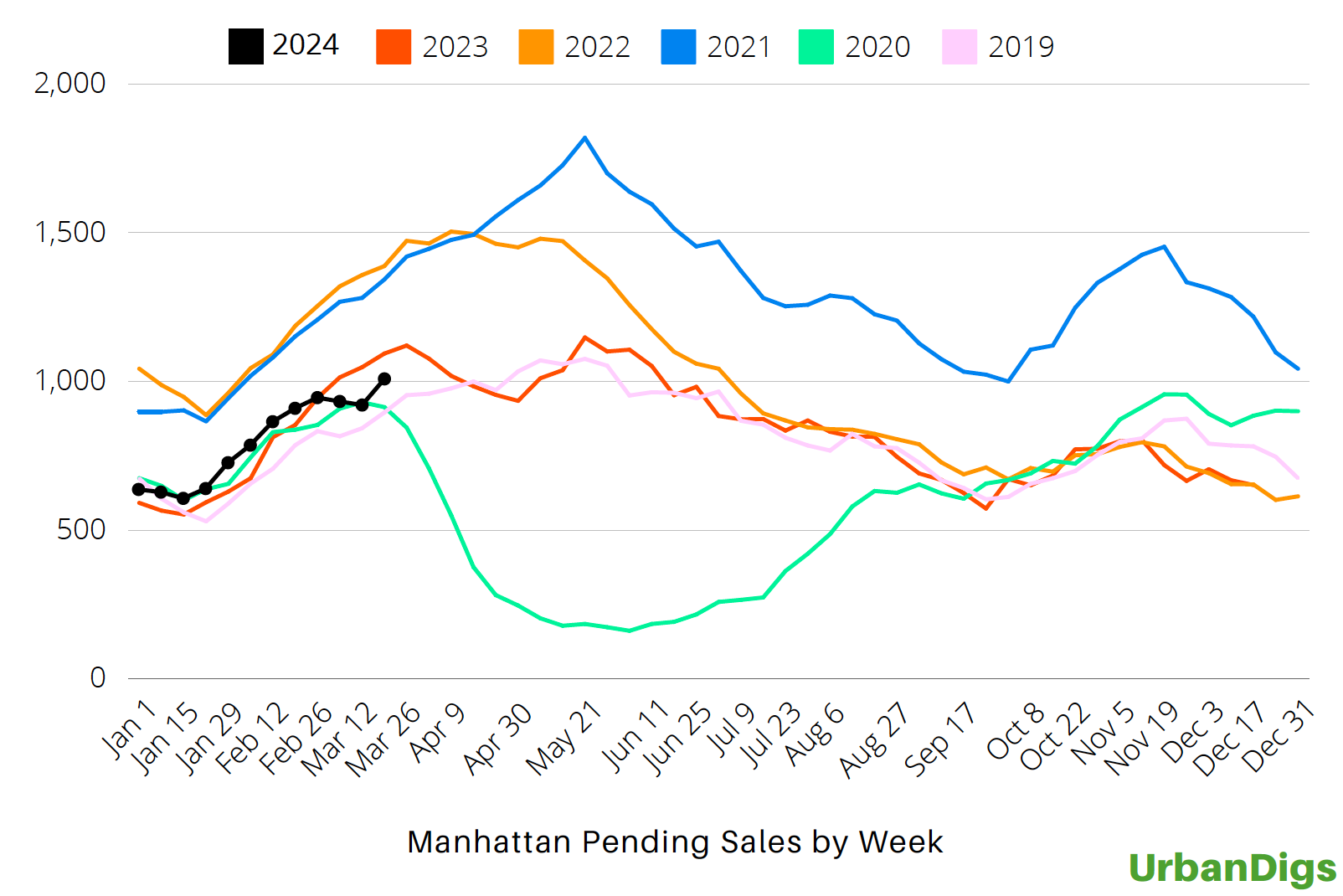

The pace of liquidity over 30 days surged by nearly 10%, indicating renewed buyer interest. The number of signed deals rose by an impressive 24%, marking the highest level in nearly a year. While deal volume in 2024 remains ahead of last year, the lead is slim.

Demand

www.urbandigs.com

Market Insights

Delving deeper into listing discounts and off-market listings reveals an interesting trend. Units priced around 16% above the median price for similar properties are facing challenges in finding buyers. This insight underscores the importance of pricing strategy in today’s market.

In conclusion, the first quarter of 2024 presents a nuanced picture of Manhattan’s real estate market. While pricing adjustments and increased time on the market indicate ongoing adjustments, the recent surge in activity and signed deals hint at a potential turnaround.

As always, we’re here to address any questions or provide further insights into the evolving real estate landscape.