Thanksgiving is fast approaching which means we are wrapping up the fall season here in Manhattan. It seems our real estate market is starting to transition towards winter. You might have heard the current real estate market be labeled as a “Buyer’s Market.” It’s a broad term that packs a very dynamic market into a very small package. Let’s break that down by looking at the current activity, negotiability numbers, and where things seem to be moving.

Current Market Dynamics

Reflecting on the year, the real estate market has exhibited a measured pace. Fall didn’t make a dramatic entrance, but buyers are seizing opportunities, leveraging their current standing. Contracts signed have surged by 43% from last month, a noteworthy uptick after a softer quarter. However, it’s crucial to contextualize this surge, merely bringing us in line with 2019, 2020, and the preceding year. The anomaly of 2021, marked by a post-lockdown surge, remains in a league of its own.

Inventory is tightening as we approach the holidays, with a 12.7% decrease since last month, aligning us with figures from ’19, ’20, and ’22. New listings for the year recently hit 15,000, a significant stride but historically achieved by September. For prospective buyers, the landscape suggests that what’s available now may be indicative of the market for the remainder of the year.

Spotting Opportunities

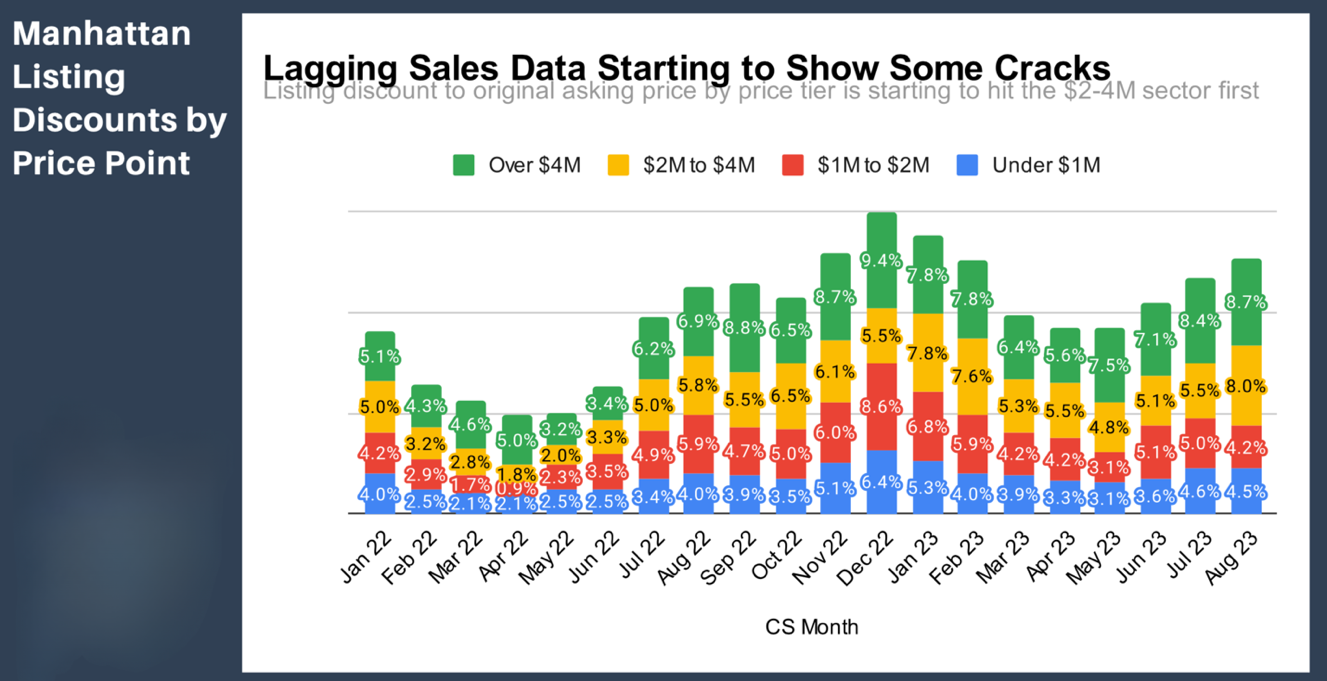

Turning our attention to deals, let’s rewind to August, our most recent concrete data point. In the $2 to $4 million market segment, discounts widened from 5.5% in July to 8% in August. While this doesn’t signify an across-the-board slashing of price tags, the numbers affirm increased negotiation room compared to the market conditions in April last year, extending across a broader market spectrum.

What Lies Ahead

Recent inflation data, revealing a continued year-over-year slowdown, has spurred positive movement in mortgage markets. Nationally, the average rate on 30-year fixed mortgages dropped by 18 basis points to 7.4% last week. With other mortgage types now ranging from 6% to 7%, collaboration with knowledgeable lenders and real estate professionals is vital to identifying the optimal mortgage for your purchase.

In essence, good news for buyers! The trajectory will unfold as we step into 2024. With dropping rates and negotiation leverage, buyers have a real shot at success, provided inventory remains favorable.

It’s worth noting that sellers working closely with agents to position their properties strategically are still reaping rewards. In a market with limited flexibility, a robust real estate team is more critical than ever to avoid missteps.

For any queries or a deeper discussion on real estate matters, please don’t hesitate to reach out via email or phone. Your inquiries are always welcome.