After a weak April, the month of May came in like a lamb and went out like a lion! Last week for example, the number of contracts signed was up 29% from the prior week. To put this number in perspective, we like to see around 250 deals signed per week to judge liquidity in the market – we saw 326 for the week.

The seasonal spring active season historically peaks in May. As we write this letter, May has ended and we have seen overall supply decline nearly 11% from the prior month and the number of contracts signed rise 23% from the prior month. What this means is that the market is liquid, balanced, and that both buyers and sellers are likely to concede a little bit on each end to get deals done. We would put negotiability at around 5% off the asking price. It will be interesting to see if we continue this trend into June or will the summer slowdown begin? The liquidity chart below shows the uptick just discussed.

Manhattan

The cumulative number of new listings for 2023 continues at the lowest level for the last several years. Manhattan inventory ticked down almost 11% compared to last month as the active listing season winds down. Given the approaching end of the spring market, supply is expected to drift down until the fall market begins in September.

While the cumulative number of signed deals in 2023 lags the levels seen 2021 and 2022, it remains above 2019. Weekly contracts signed spiked to its highest level this year, crossing the 300 mark for the first time since May 2022. Overall, May has been a strong month for contracts signed in Manhattan.

With the active season waning, the market pulse and liquidity pace are maintaining their positions in neutral territory.

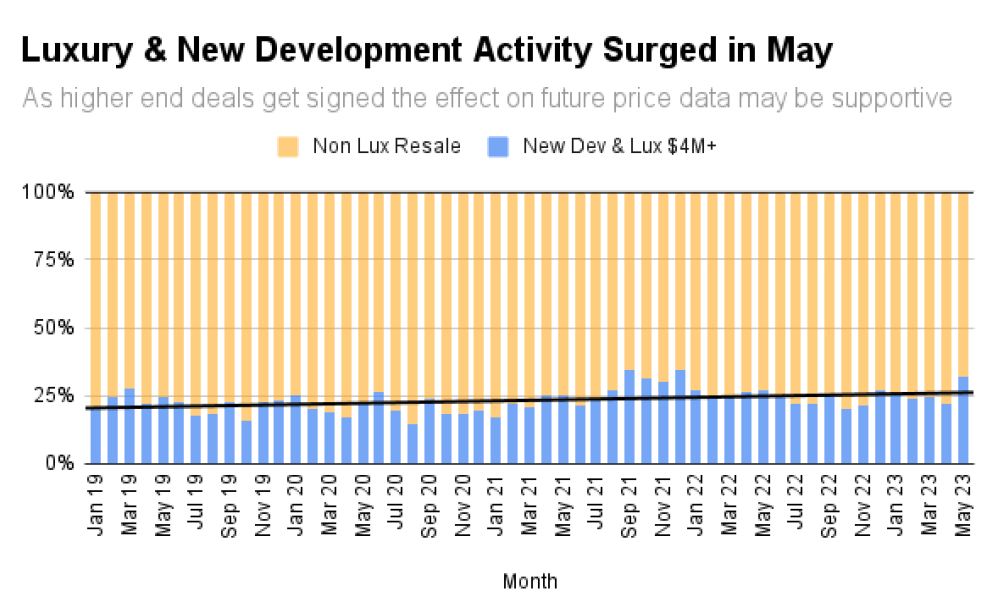

Breaking apart the number of contracts signed, the market share for new development and luxury units is approaching peak levels last seen in late 2021, hinting that overall prices may see some support.

Advice for Sellers:

Take advantage of this significant bump up in deal volume as conditions remain liquid to move property that is priced at market. If your property is lingering, now is a good time to adjust price before the slowdown hits.

Advice for Buyers:

If you have a timely need to buy, this market is not offering many leverage advantages given the balanced marketplace. Supply is in a neutral place, demand is up, rents are at record highs and there are a lack of motivated/desperate sellers seeking to hit low ball bids. It’s likely this seasonal cycle is peaking out now. If you have the luxury of time, history suggests there will be a leverage drop in your favor as we near the end of summer and early fall at the expense of tighter supply conditions.

If you have questions, please call or email anytime.