Memorial Day Weekend is two weeks away. Crazy. The New York City real estate market continues to be a head-scratcher. Where are we going? We think we could be in for an unusually busy summer. Here’s why:

March deal flow in sales was on fire. April deal flow in sales was anemic. May deal flow in sales is shaping up to be pretty good. Not great, but not bad either. Sales inventory is low. The rental market is insanely busy with no relief in sight. Pent-up demand from buyside is high. The key is pricing it right. All eyes remain on the Fed.

In Manhattan and Brooklyn, we’re still seeing upward movement in areas.

Supply? Up.

Demand? Still up.

The fact that both are rising at a similar pace is preventing any major leverage shifts between buyers and sellers – for now. Our market can change drastically from week to week, and it’s in the weekly numbers that we are starting to see some early signs of seasonal change.

Shifting out to the macro level, as expected the Fed announced a rate increase of .25% after their May 3rd meeting. Their 10th consecutive increase in under a year. Could they now pause on further increases for now? Some signs are pointing to yes. If so, it may have the potential to boost consumer confidence and ripple into the housing market. With their next meeting on June 14th, we will be very interested to see what direction they decide to go.

Macro events will dictate where we go from here. We are here and not going anywhere. We encourage you to reach out if you are contemplating a real estate transaction.

MANHATTAN

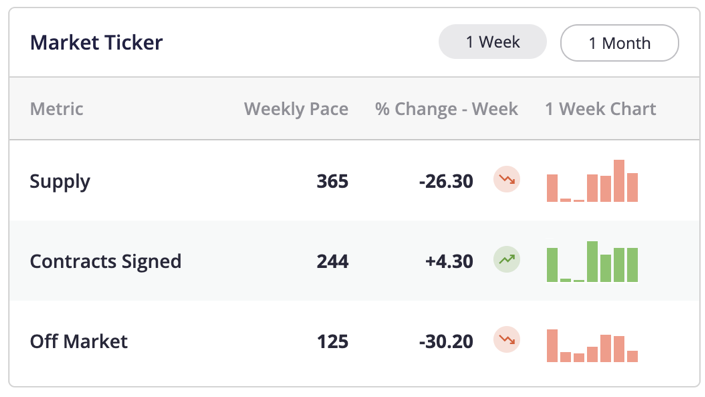

Weekly Market Ticker (5/12/2023)

www.urbandigs.com

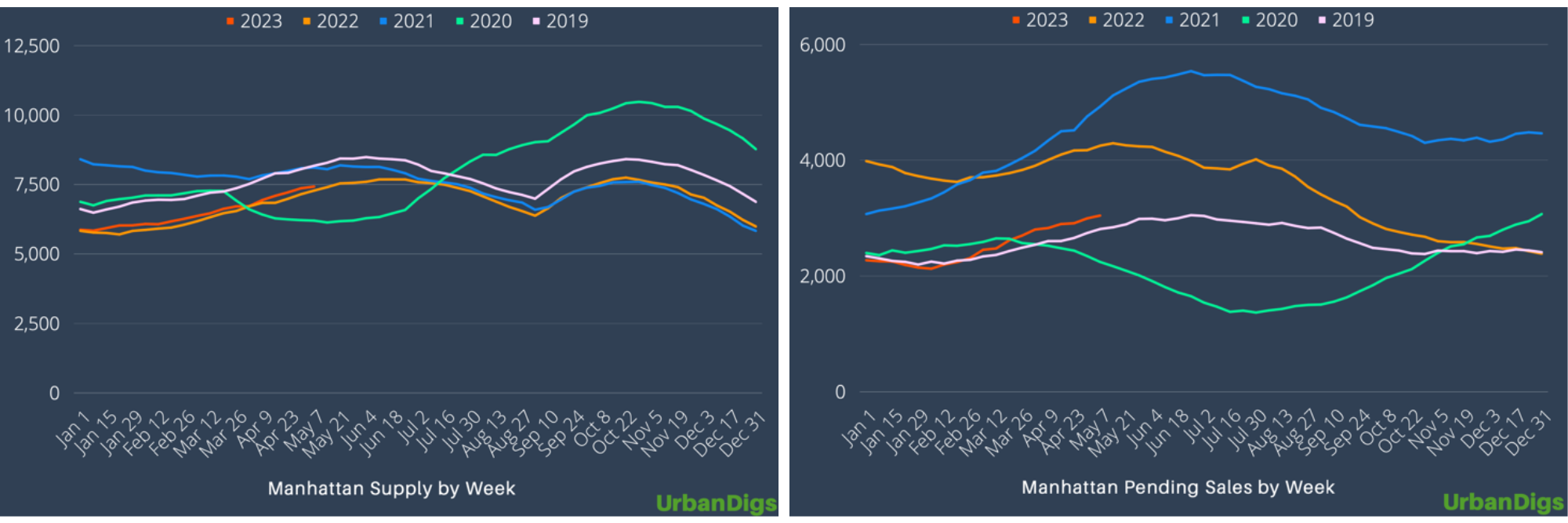

In Manhattan, total supply numbers are still moving up, if a little slower than earlier this month. It seems like we could still be a couple weeks away from the seasonal peak.

In one of the larger shifts, weekly new listings dropped 26% since last week. This could be an early indicator that the spring’s main listing wave is passing. Next week’s numbers will be very telling on this.

Contracts signed rose 4% and pushed the pending sales up for another week. This all has put some upward pressure on liquidity, which is good sign of market health at this point in the year.

www.urbandigs.com

BROOKLYN

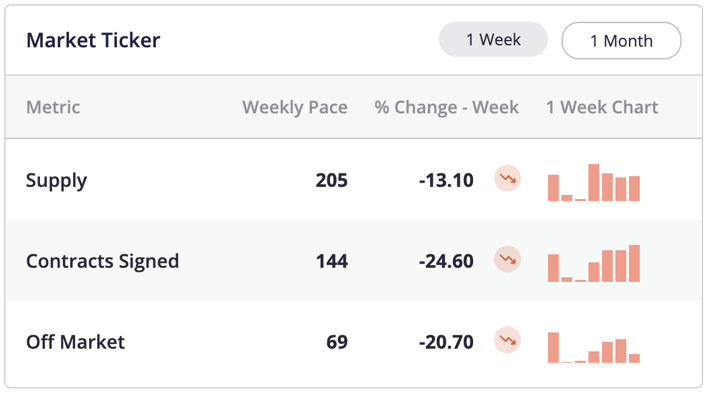

Weekly Market Ticker (5/12/2023)

www.urbandigs.com

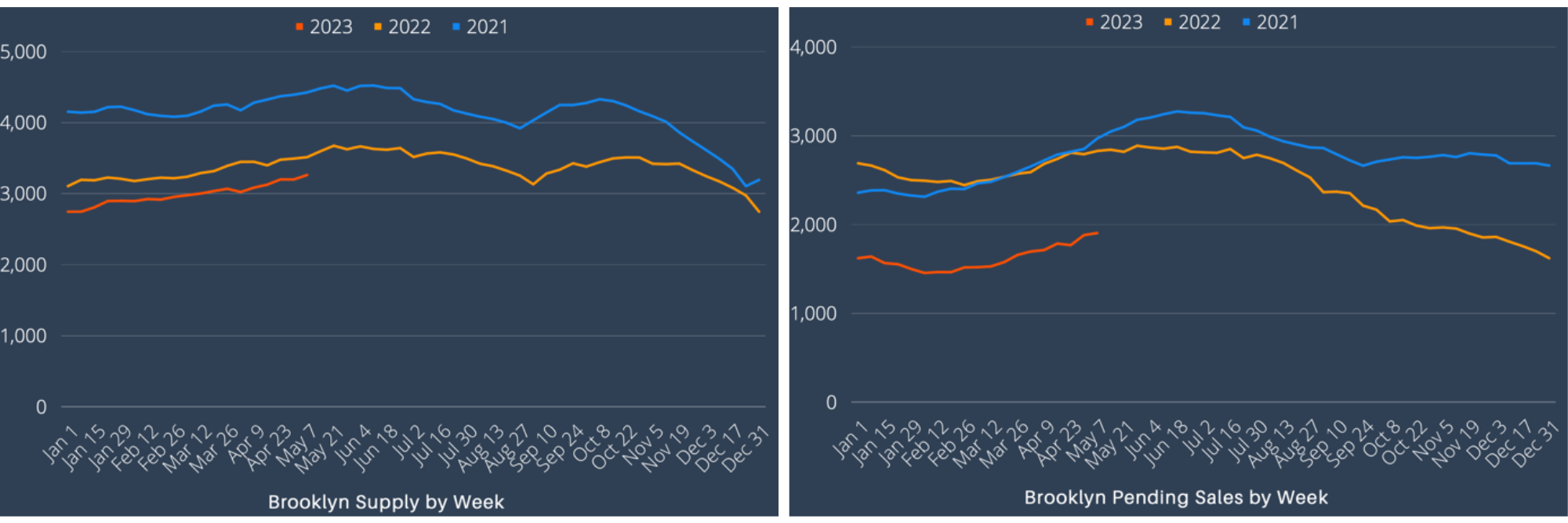

Overall supply and pending sales in Brooklyn both continue to inch up slightly. As we zoom in on the weekly numbers though, we start to see some downward movement.

New apartments coming on the market dropped 13%.

Weekly contracts signed fell 24.6%.

Overall, the Brooklyn market can be a bit more volatile than Manhattan. It’s possible that could make for a less gradual move into a slower summer market. Is that time now? Still too early to say, we will be watching this closely.

www.urbandigs.com

The NYC market moves extremely quickly, especially at this time of the year. We would be happy to have a deeper discussion if real estate is on your mind.

As always, please call or email with any questions.