Rents are high. Mortgage rates are high. Housing participants in New York City are stuck between paying up for leases and having less affordability on purchasing.

This is a peculiar time. On a positive note, (and we do look for the positives!) both Manhattan and Brooklyn markets are maintaining supply and demand levels as expected for a spring market. Manhattan does not really have a supply problem. Brooklyn supply continues to underwhelm. Both Manhattan and Brooklyn markets are holding steady in neutral territory.

Is inflation whipped? Doubtful. The markets have priced in a quarter point interest rate hike for May 3rd meeting. For sure, we are in an inflationary bear market. We keep track of the data, interpret the data, and report it to you so that you can make thoughtful real estate decisions. Here is the Fed meeting schedule through Summer: May 3rd, June 14, July 26, September 23rd. A lot of speculation around what the Fed will do (hike, pause, cut) and we will keep you informed as we roll through this period.

If we have learned anything over the last couple of years, it is this: expect the unexpected. At this point, we are hoping for the late spring market bloom. Fingers crossed. Watch this space.

MANHATTAN

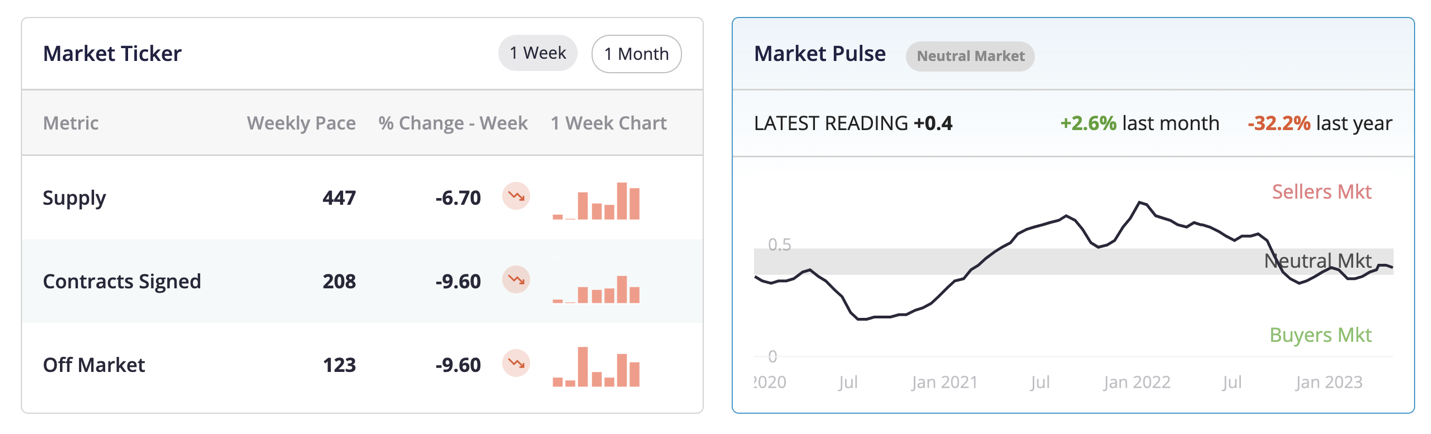

Weekly Market Ticker (4/28/2023)

www.urbandigs.com

For a leading indicator on what’s truly going on, we turn to the weekly numbers. This is important because before week ending 4/21/23, it was incredibly slow. In Manhattan, the third week of April saw a 30% (555 new listings) jump in supply which is a huge number. However, it’s very important to put this into perspective. Last year at this time, we had seen eight weeks with a 5-handle on weekly new listings. Unfortunately, the fourth week, week ending 4/28/23, of new supply was back in the 400 range. This is still within the normal range for this time of year, however, we would have preferred to see another 5-handle last week.

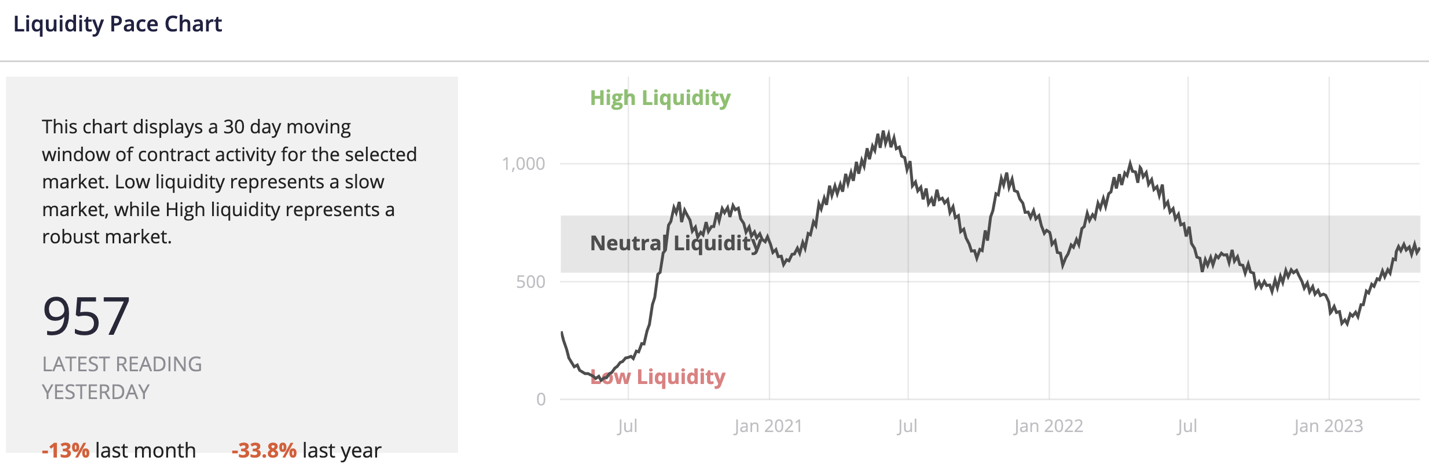

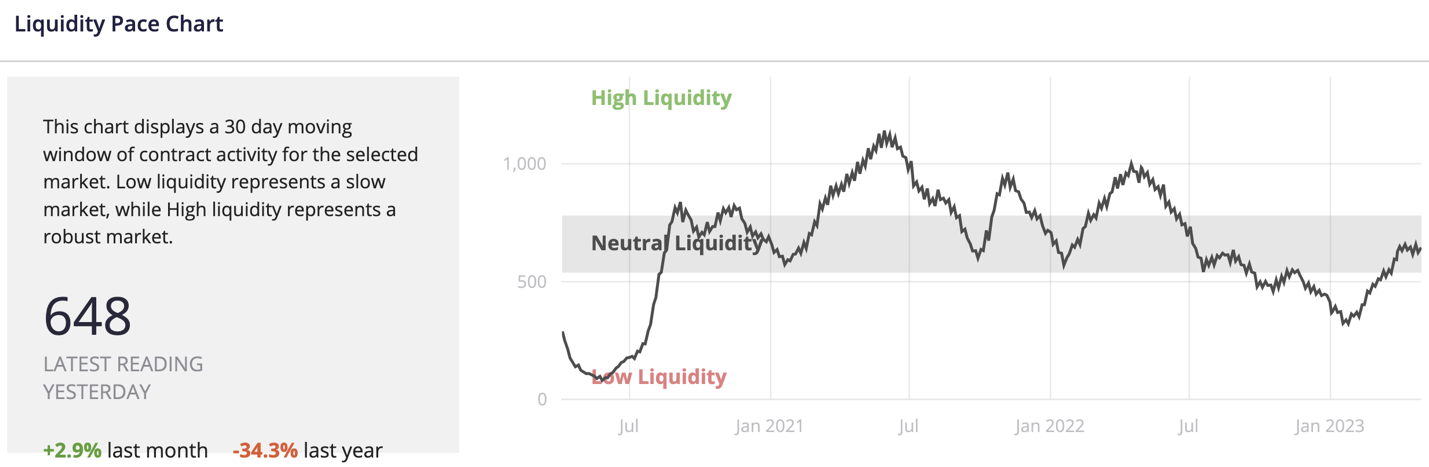

Weekly contracts signed activity dropped a bit but remained ahead of weekly new listings activity which helps retain market balance. Having said that, we are well below the highs of 2021 and 2022. Can the season keep pushing higher? Will the liquidity remain to keep powering this busy season? Only time will tell. Again, watch the weeklies.

www.urbandigs.com

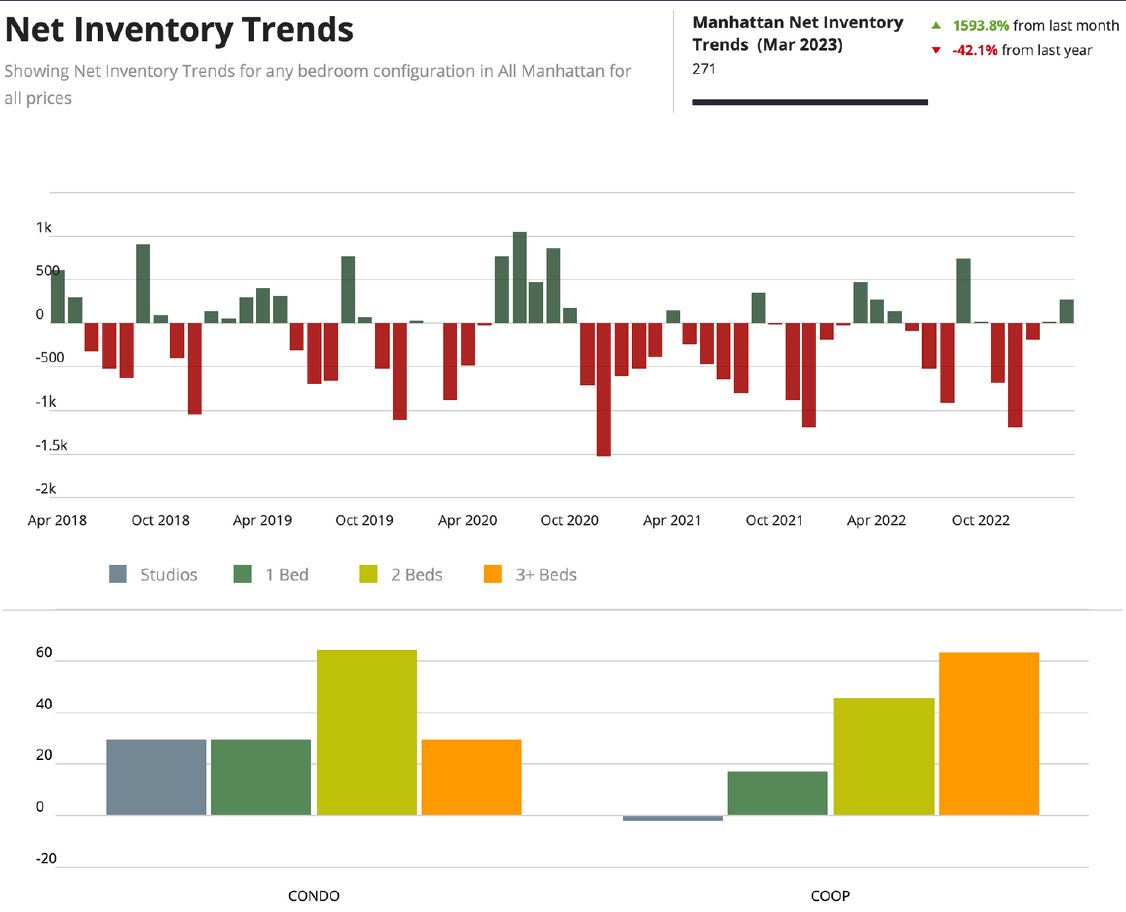

After subtracting contracts signed and off market units from the count of new listings, the net inventory trends are rising. This is a measure of how buyers “feel” about the market and suggests that the window of opportunity for sellers may be closing.

www.urbandigs.com

BROOKLYN

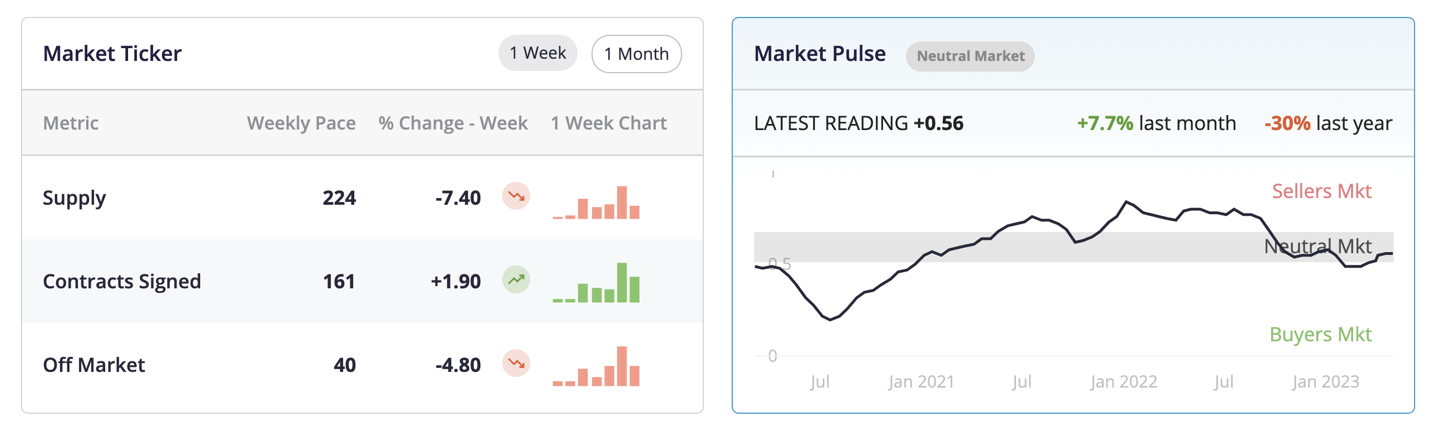

Weekly Market Ticker (4/28/2023)

www.urbandigs.com

There is an upbeat mood going on in Brooklyn. A week after passing the 3,100 total supply mark, Brooklyn inventory cruises past the 3,200 mark as the pace of supply heated up. This is awesome because in a typical spring season, there is not a lot of time left. Having said that, we are hoping that spring 2023 leans more toward atypical much like 2021. This time last year, we were beginning to see the slowdown.

After spiking to season highs, Brooklyn weekly contracts fell as the market continues to lag previous years. The widening gap between last year’s production and this year’s production clearly shows how the Brooklyn market is off to a slower start. The jump in contracts sign the 3rd week of April was exciting. Will we see more upward momentum in coming weeks? We have no idea. Got to watch the weekly data.

www.urbandigs.com

Brooklyn net inventory, the difference between units coming on and units going off the market remains positive, but a closer look suggests the condo market feels much tighter than the coop market.

www.urbandigs.com

Is the spring market heating up?

Time will tell. We remain glued to the data. Manhattan and Brooklyn feel very much alive.

If you have questions, please call or email anytime.

Recent Comments