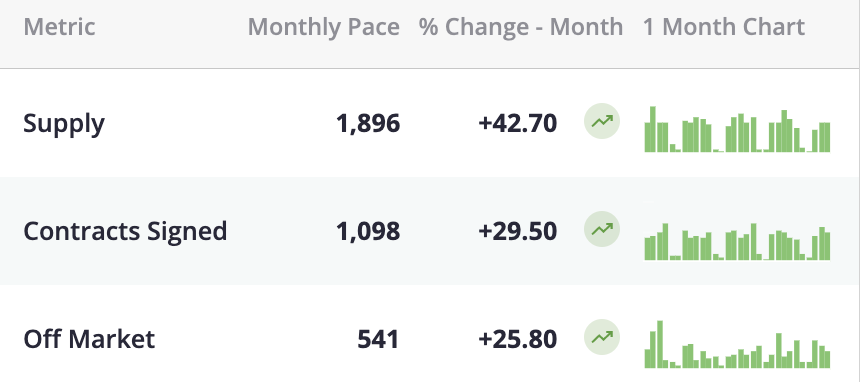

With all the macro events going on around us, the New York City real estate market appears to be on an uptrend in both overall Manhattan supply and demand. We will take it! Surprisingly so, the market is doing what we would expect it to be doing during this time in the season.

Manhattan Metrix:

The Manhattan market is finally in the net surplus territory – Supply (inventory) is larger than the combination of Contract Signed and Off Market.

www.urbandigs.com

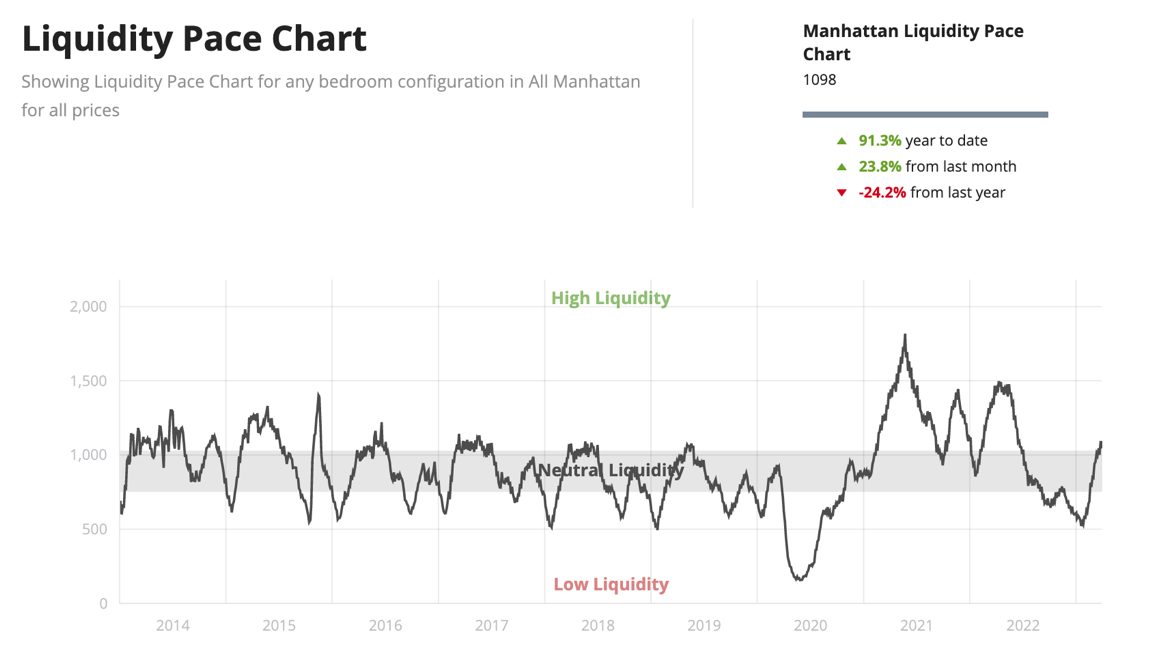

We have about another week or two to go before we hit the peak of this listing season. What then? Don’t know. What we do know is that the liquidity in this market right now is real. Contracts signed are trending upward on a weekly basis so far.

www.urbandigs.com

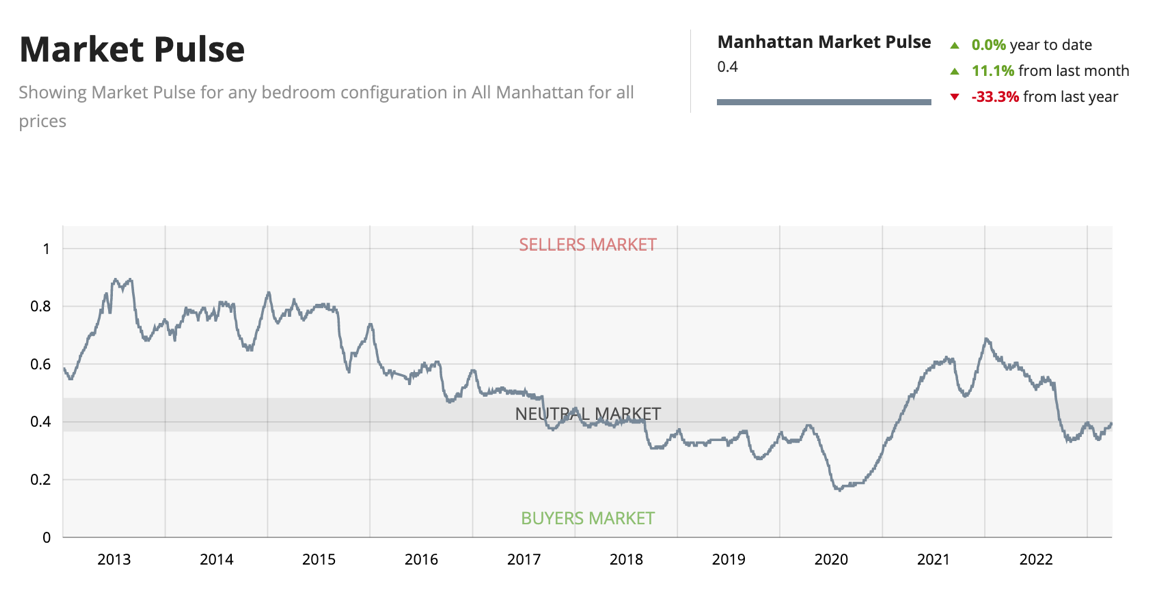

With all of the recent turmoil on the economic front, the New York real estate market is taking the hiccups in stride. The spring market is doing its own thing and proceeding with business as usual. As demonstrated by the Market Pulse, Manhattan is maintaining its neutral position.

www.urbandigs.com

Advice from our UrbanDigs experts:

Advice for Sellers: Take advantage of this bump in liquidity to get bids signed. You have until May when seasonality starts to slow just as macro risks and uncertainty are rising. Listen to the market and adjust your price accordingly. For those sellers waiting until Fall, consider pulling forward that listing if possible and attempt to get a quick sale in today’s markets given the unknown of time that lies in the months ahead and its potential impact on liquidity in our markets.

Advice for Buyers: Current markets do not yet reflect the risk off tone that has hit the banking sector and equities. Supply and deal volume are both trending higher. Sellers are for the most part not fearful so expect tightness in bid/ask spreads. It’s possible our markets remain tight and active until May/June, barring any further shock to the markets. For buyers who missed peak leverage a few months ago, expect another chance as the slow season and macro risks converge over the summer.

Rent vs Buy:

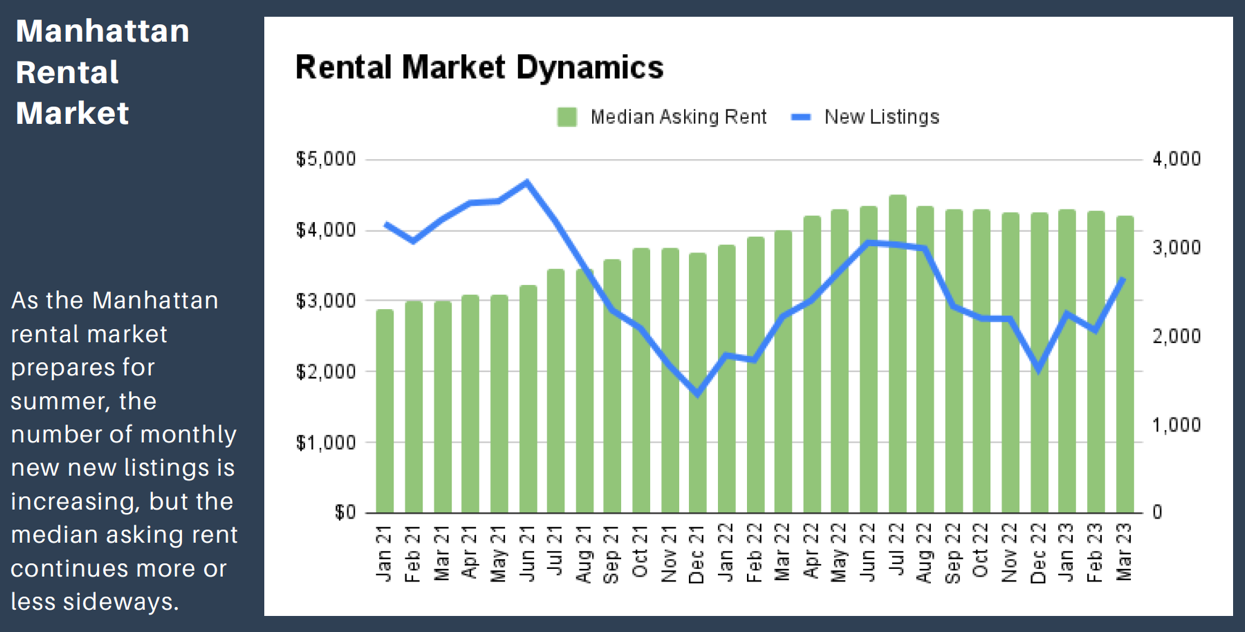

We are having some interesting conversations with “should I buy or should I rent” people. In our opinion, the rental market is still tight. We do not see any massive opportunities in terms of price drops or concessions coming out of the rental market any time soon. We believe there is better negotiating power on the sales side right now. With the added caveat, the decision to buy is a long term commitment.

www.urbandigs.com

If you have questions, we have answers. Call or email anytime.