It is hard to believe we are nearing the end of the 1st Quarter. In addition to the interest rate environment, inflation, FED decisions, inventory – we added to the pile this past weekend with the failure of SVB and Signature Bank. In a word – STOP! How much more can we take? Good question.

The positive news is that the New York City real estate market is showing the signs we would expect in the spring market. As a reminder, the spring market is our strongest and most active period of the year. Liquidity is coming back albeit the Manhattan and Brooklyn markets are demonstrating different dynamics.

Market Action Continues to Build

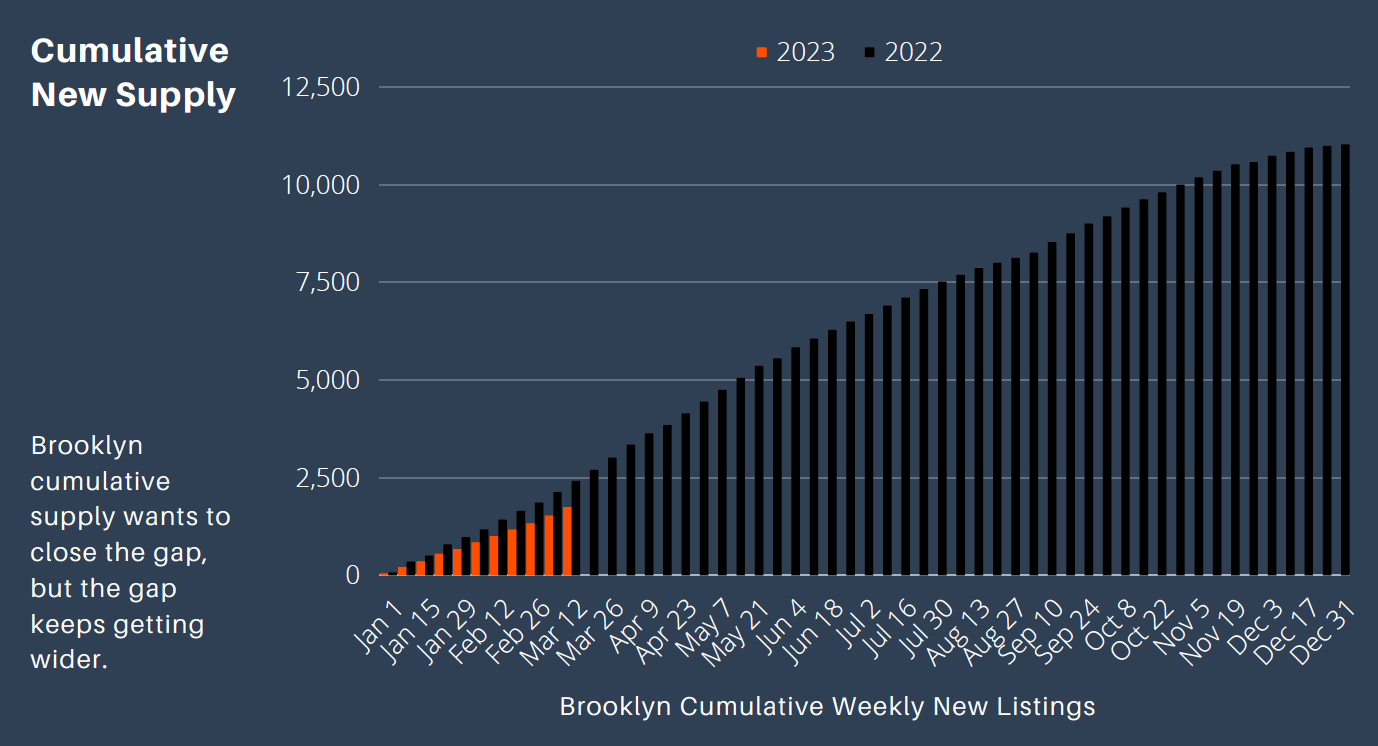

Manhattan Supply – Cumulative New Listings

www.urbandigs.com

Manhattan supply has turned a corner and supply is now a net surplus. For the first time this week, new units coming to market are higher than units leaving the market – i.e. units going into contract and units being taken off market. This should unleash supply.

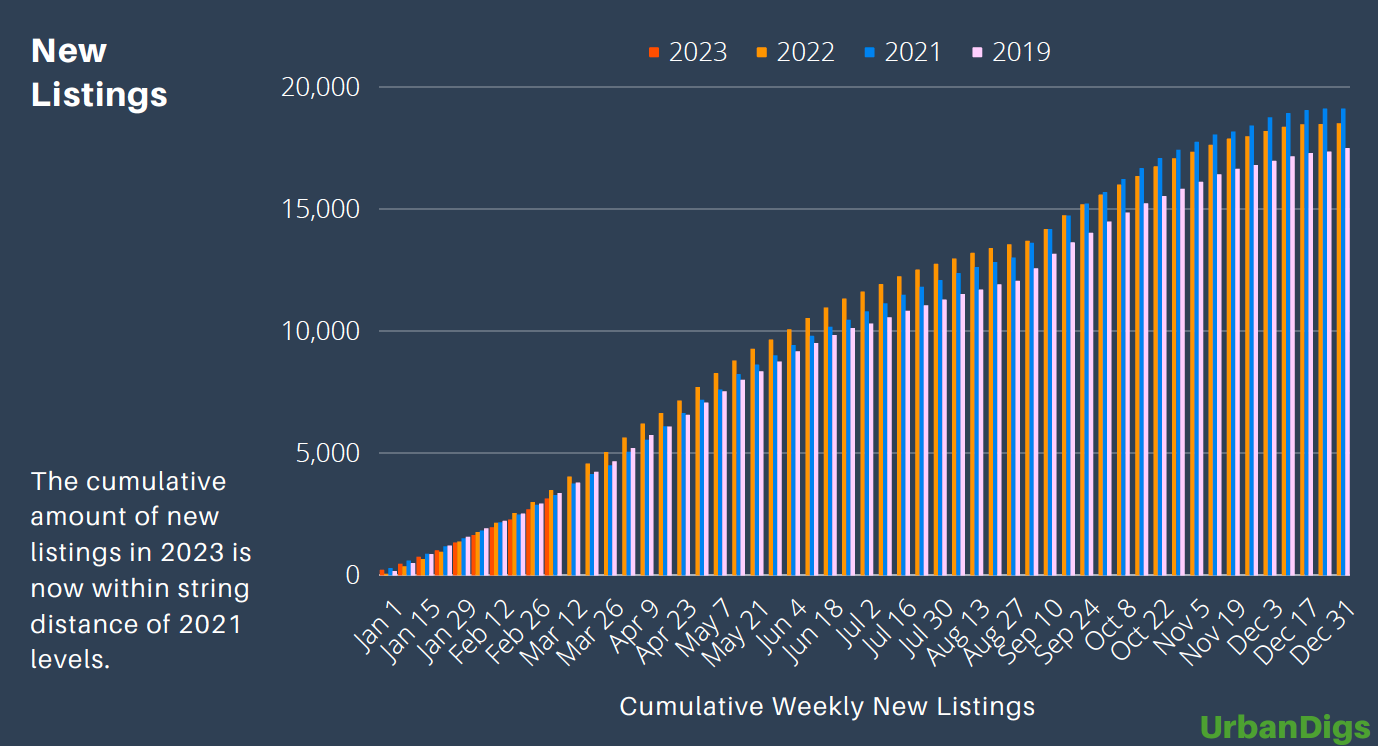

Brooklyn Supply – Cumulative New Listings

www.urbandigs.com

Unlike Manhattan, Brooklyn continues to be supply constrained. Inventory continues to experience a net deficit of new listings. There has been a long slow supply drought. Only time will tell if the Brooklyn trend shifts to follow Manhattan.

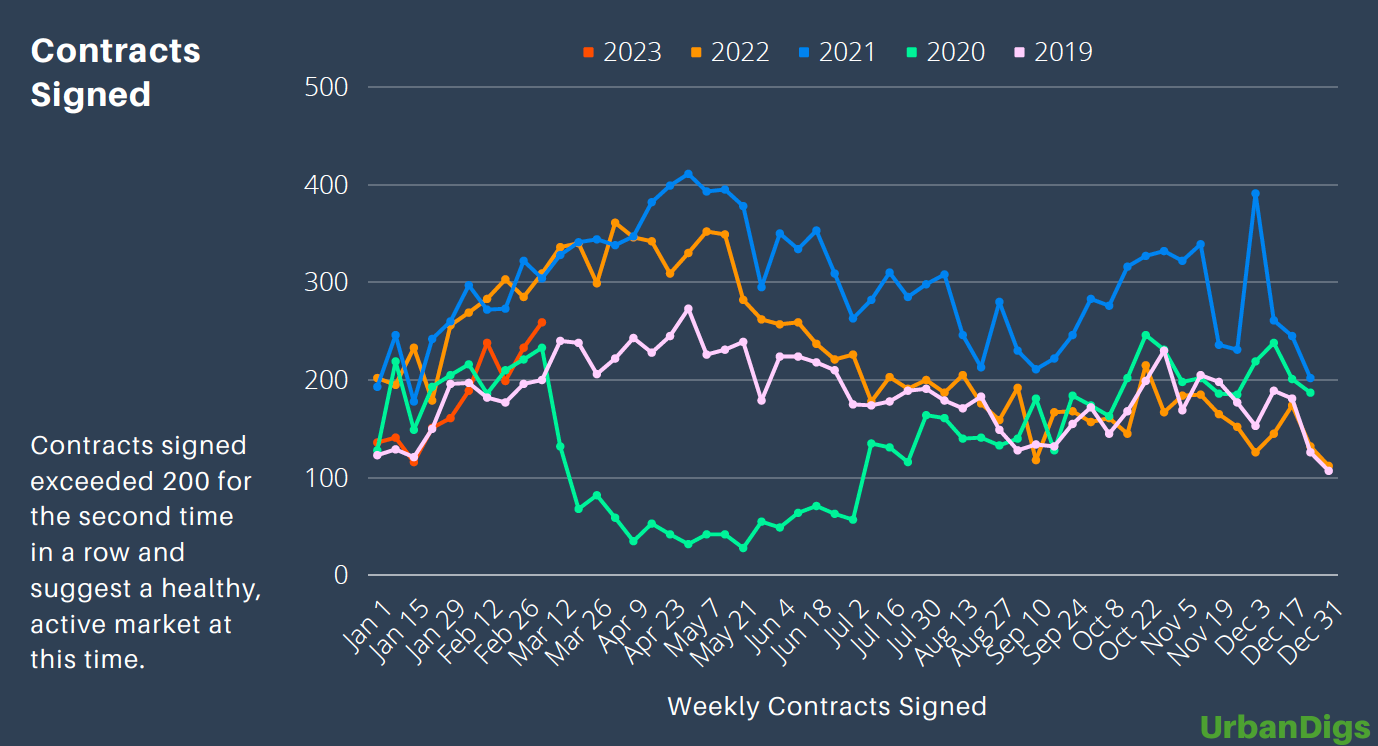

Manhattan Weekly Demand – Contracts Signed

www.urbandigs.com

Manhattan Pending Sales started to rise in mid-February with deals going into contract. The last 30 days has shown a notable pick up with deal volume up 50%. Manhattan is showing increased liquidity in the real estate market notwithstanding the stock market volatility and is on trend for a healthy season.

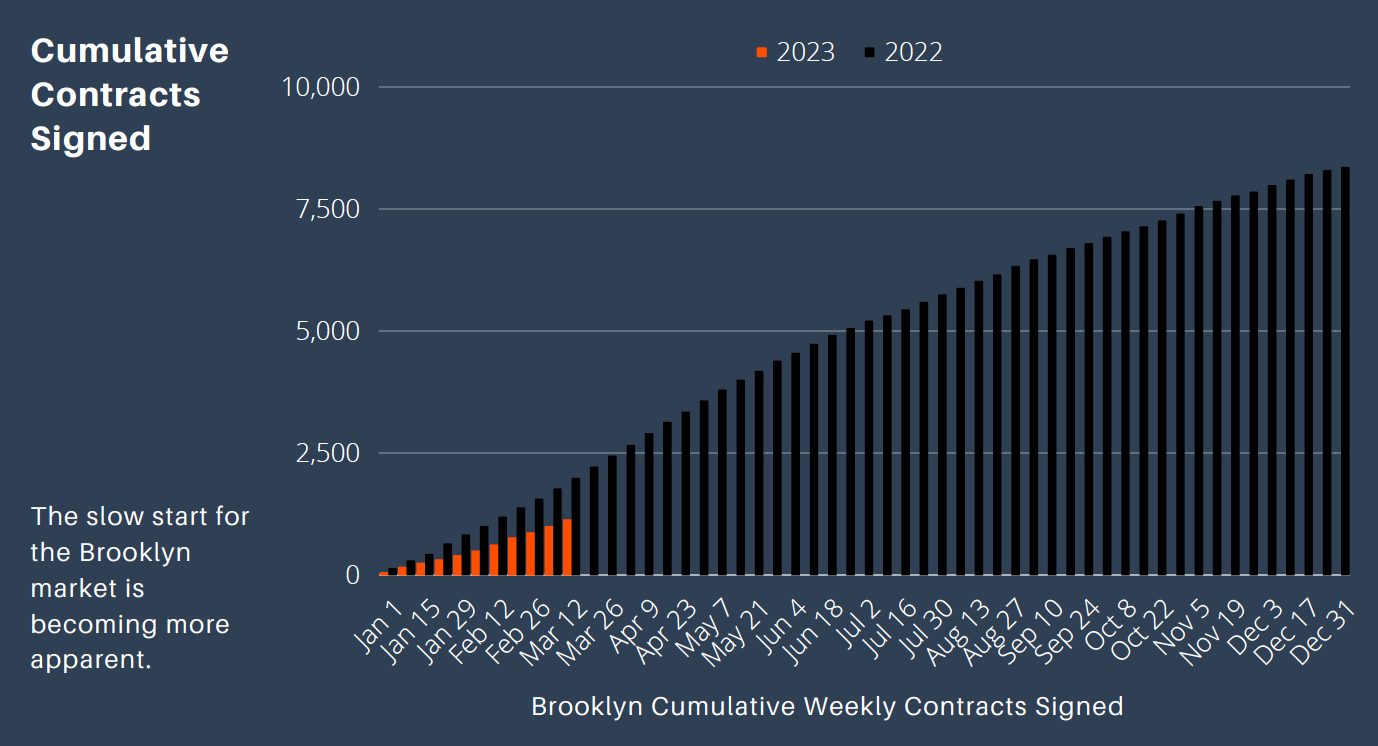

Brooklyn Weekly Demand – Contracts Signed

www.urbandigs.com

Brooklyn demand is being constrained by the lack of inventory as noted in the Brooklyn supply chart above which is a very different dynamic from Manhattan. Overall, sellers have a better leveraged advantage in Brooklyn. The trend in contracts signed is not increasing in the active season as normally expected.

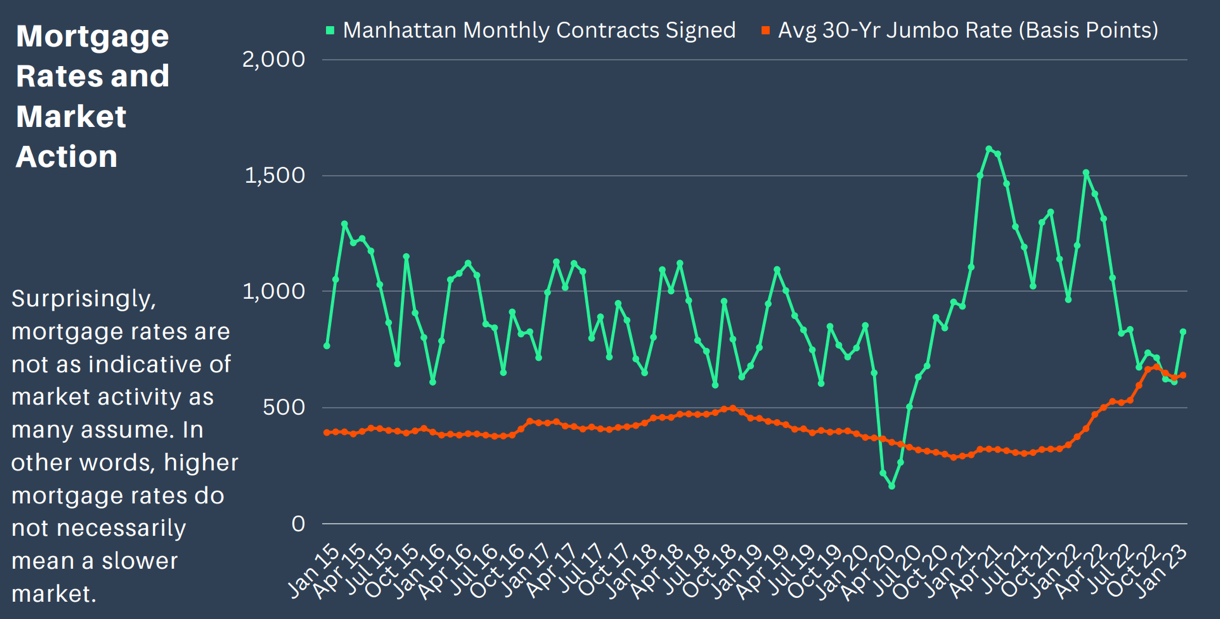

The Correlation of Interest Rates to Market Activity

www.urbandigs.com

This chart deserves a conversation if you are a buyer or a seller. This data demonstrates the current correlation of rates and contract activity in the Manhattan market. The bottom line is that yes, rates are a factor, but they are not preventing buyers and sellers from transacting. Liquidity is coming back, and deal volume is up 50% over the last 30 days. Given the normally large proportion of cash sales, the market will do its thing regardless of rates. As we have been saying, well-priced properties have a very high likelihood of getting a bid in this spring season.

If you have questions, we have answers. Call or email anytime.

\

\