As we begin the active season, the cumulative number of listings hitting the Manhattan residential real estate market appears to be back in-line with previous years. Please do not misinterpret this as “recovery.” It is not. With demand way down from where we were this time last year, we believe we are two to four weeks out from calling the bottom.

This market is in limbo! Having said that, it is early days for sure. We still have 30-45 days to go before we can understand which way this market is going.

Our position remains that Manhattan is in buyer’s market territory. Deals are getting done. Buyers do have negotiating power, but it will depend on the seller to determine just how much. Plenty of sellers are coming off the market altogether or are renting and sitting tight. Sellers if you are willing to price realistically and negotiate, stay the course.

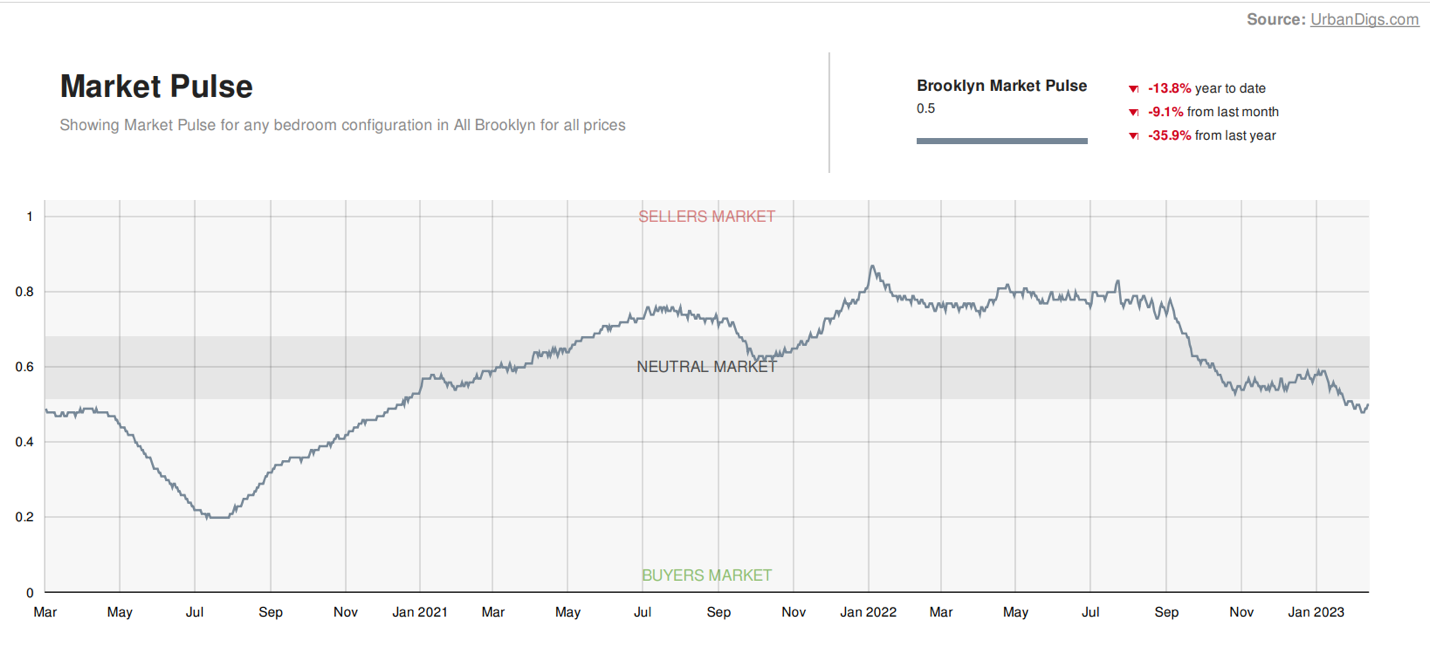

It’s important to note that last week the Brooklyn Market Pulse entered buyer’s market territory for the first time. If you would like a deeper discussion on Brooklyn, please call us.

Let’s get into the charts:

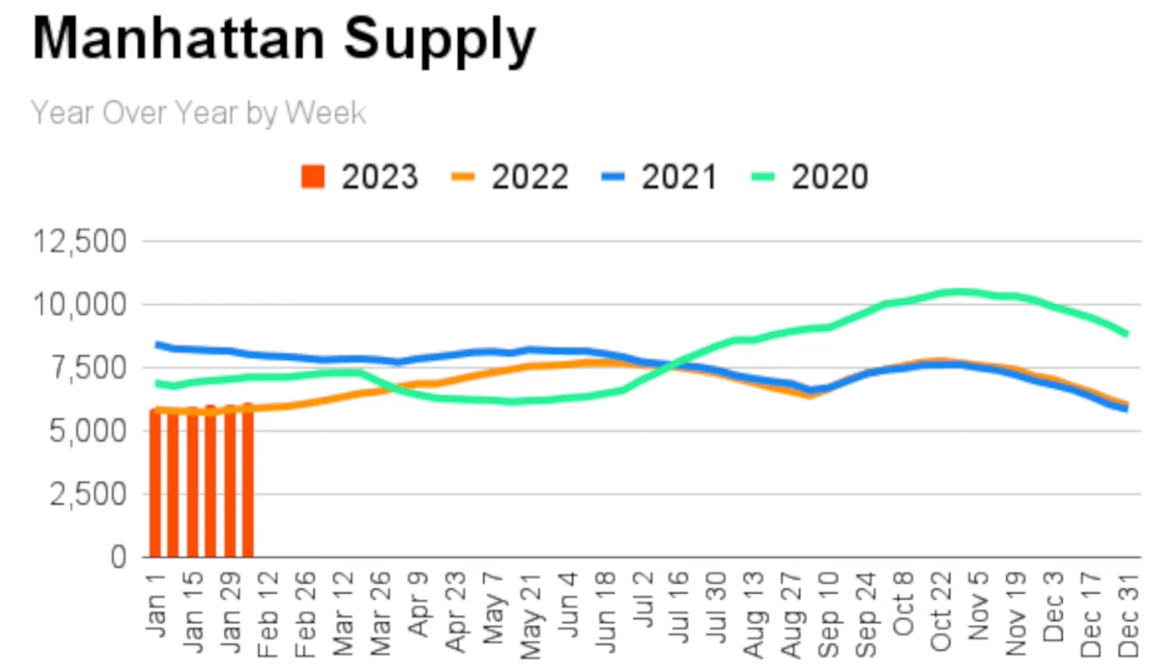

www.urbandigs.com

Manhattan inventory is ticking up, but barely. Overall supply is being constrained but it’s not from lack of new listings. Then what’s the story? It’s the number of units leaving the market due to signed contracts and sellers taking listings off market. Sellers are just not listing if they can’t get their price. They are either coming off the market altogether or are renting.

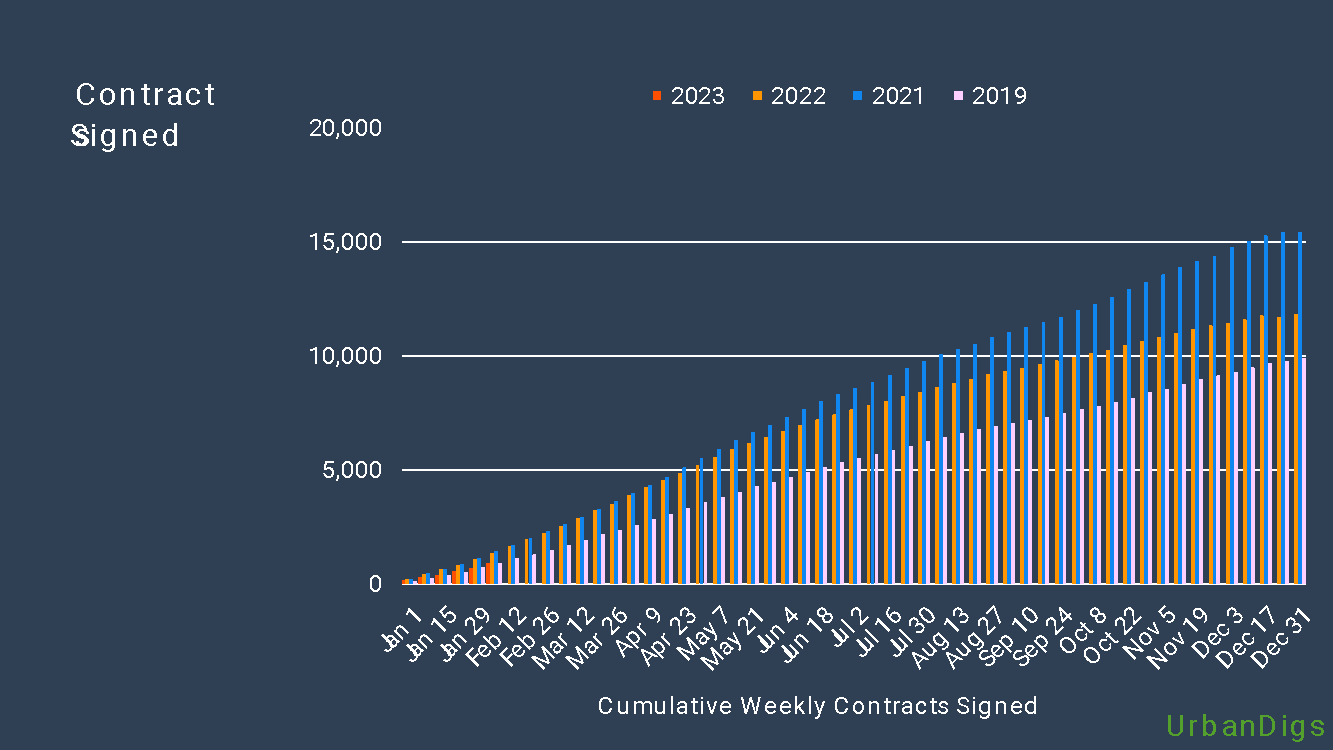

Cumulative Contracts Signed Chart – Manhattan

www.urbandigs.com

This chart demonstrates what we pointed out in our opening preamble. Yes – cumulative contracts signed is far below where we were in 2021/2022. However, we remind you that 2021 into the beginning of 2022 was a rarity in terms of absolute deal volume. Today we are looking more like 2019 which wasn’t the greatest year but wasn’t the worst either. We believe that the data so far is telling us 2023 is going to be a lower deal volume year. Time will tell if we are accurate or way off.

Market Pulse Charts

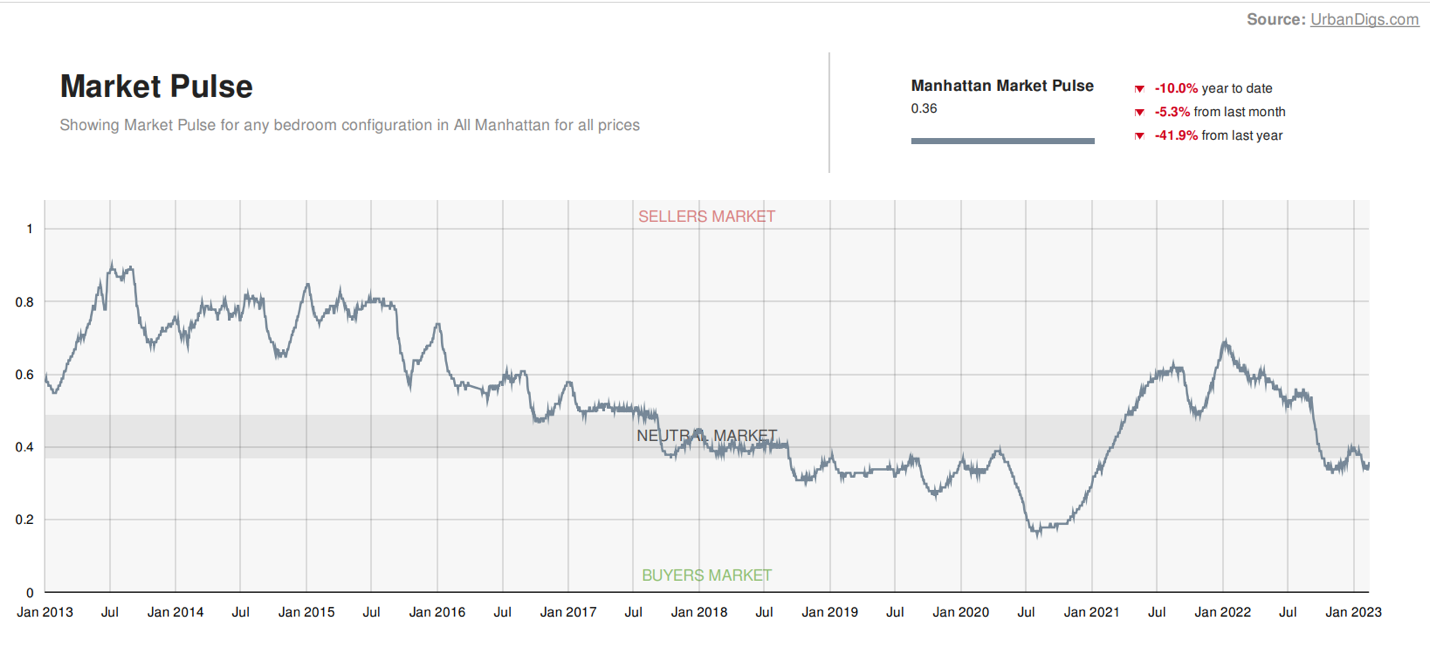

We love the Market Pulse Charts. As you can see below, Manhattan and Brooklyn are both in buyer’s market territory according to UrbanDig’s Market Pulse ratio.

Again, for both Manhattan and Brooklyn, it is early days. Buyers are going to have to wait a little longer for the new inventory to present itself.

Market Pulse is the ratio between pending sales (a measure of demand) and supply. An increase indicates a strengthening market. A decrease indicates a weakening market.

Market Pulse – Manhattan

www.urbandigs.com

Market Pulse – Brooklyn

www.urbandigs.com

The Market Pulse Index for Brooklyn is showing Brooklyn in buyer’s market territory for the first time since the end of the pandemic, but with supply low, it may be a buyer’s market in name only.

There is a lot to discuss in the charts above. If you are considering a real estate transaction, we urge you to call us. There are opportunities for both buyers and sellers given the state of the market.

As always, we are here to be your real estate advocates. Call or email anytime. We would love the opportunity to talk with you.