Happy New Year! We are rested and ready to go! As we consider 2023, we would love to tell you that 2022 is behind us. Is it though? We’re not sure yet is the answer because much of what caused the volatility and price pressure in the second half of 2022 is still unresolved – the 4Q2022 Market Report provides more detail. Having said that, we believe we could begin to turn the corner at some point mid-year. We discuss these five (5) important factors in our blog:

- Inventory

- Demand

- Inflation

- Interest Rates

- Pricing

Our job is to bring you data in real time so that you can make informed decisions. We are telling you here that we are in a buyer’s market. This is an optimal time for serious buyers to have a leg up in the price negotiation. These times are rare. If you are a buyer, call us! If you are a seller and are realistic about price, there are buyers ready to talk to you.

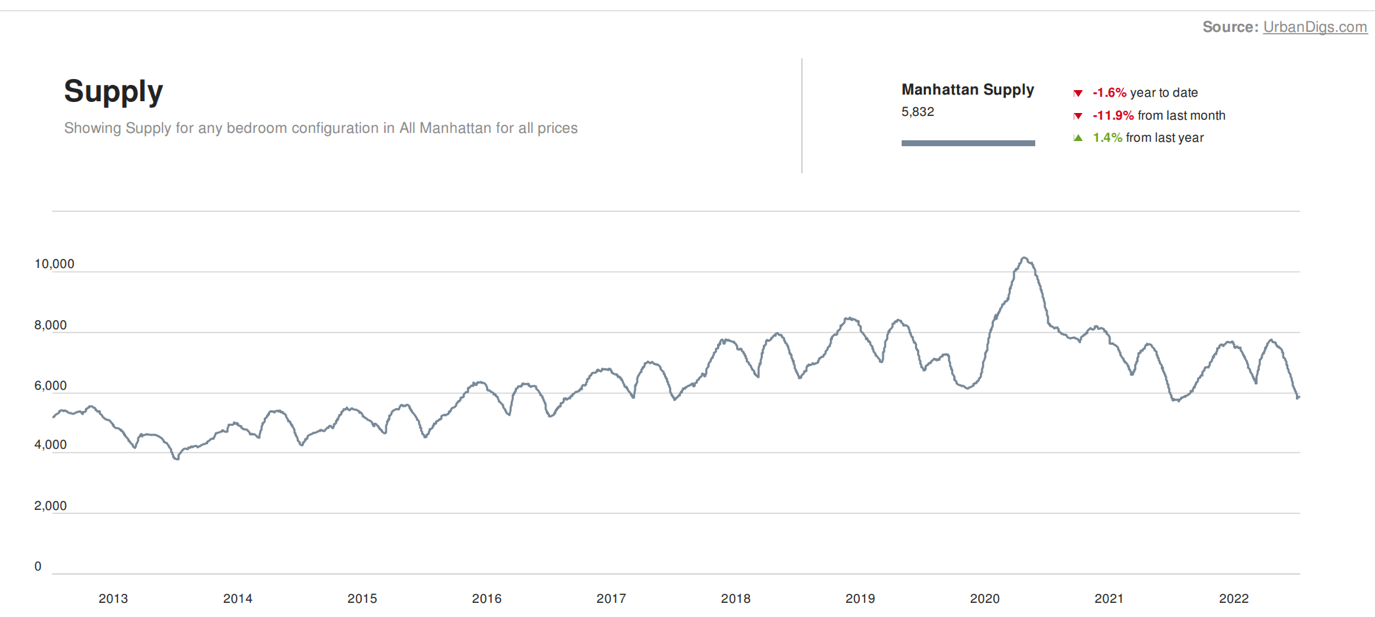

1. Supply – is our measure of inventory, i.e. the supply of available units. Supply at less than 6,000 units is low. We ask ourselves two questions: (1) is this seasonal; or (2) is this macro? We have analyzed the numbers and we can confidently say that there is nothing macro going on with supply. It’s all seasonal.

Source: UrbanDigs.com

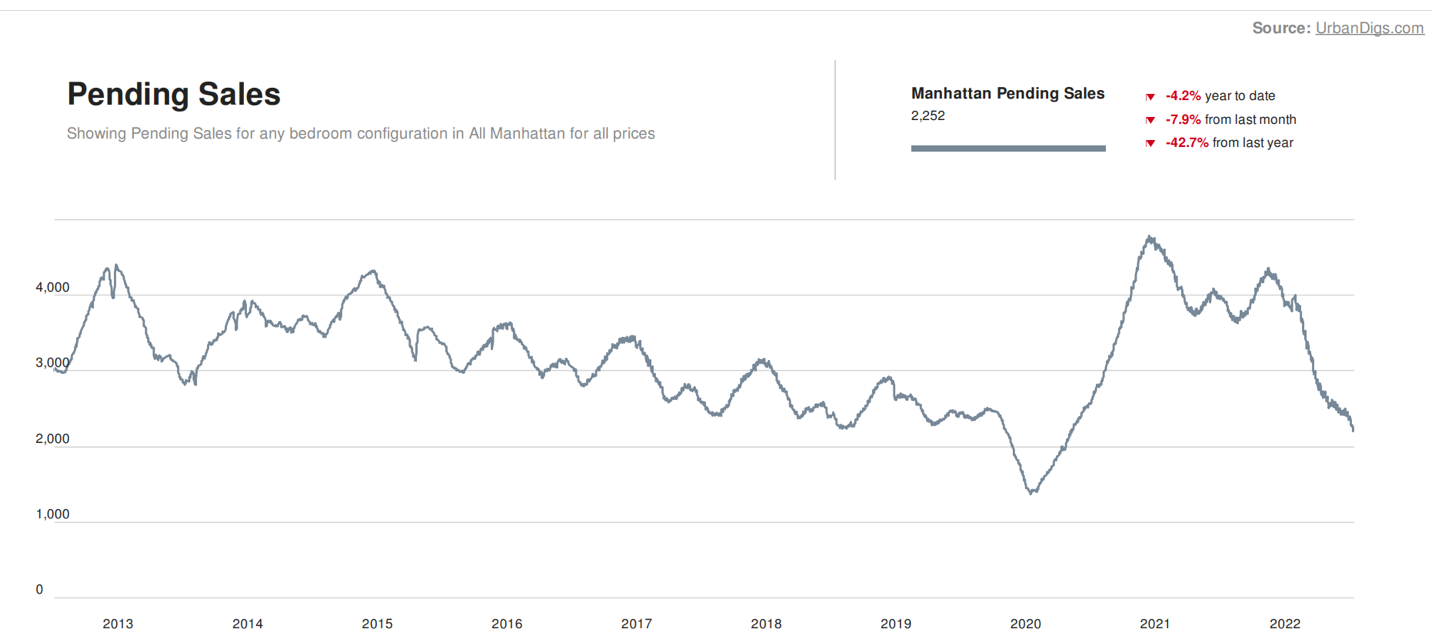

2. Pending Sales – our measure of demand. According to Urban Digs, pending sales are down over 40% from same time last year. Transaction volume has decreased dramatically and what we are seeing in the data is if sellers are not getting their prices, they are either coming off the market or contemplating putting the apartment on the rental market. For the sellers who need to sell, this is where the ready-to-go seller meets the ready-to-go buyer. The buy window is open.

Source: UrbanDigs.com

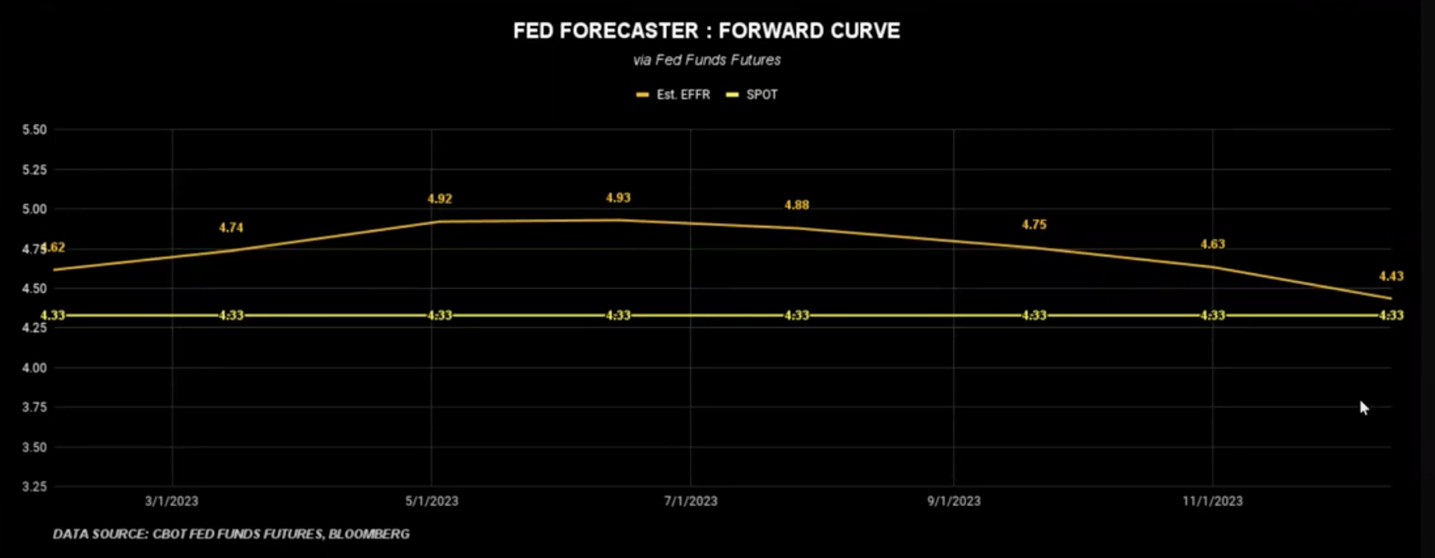

3. Inflation – yes the driving force behind this market is the Federal Reserve. When are rates going to stop rising and begin falling? The January 13th CPI number was just announced and is in-line with expectations and suggests moderate cooling, but is this a weakening inflation trend? We think so, however, the push and pull between the Fed and the markets is where we remain for now.

4. Mortgage Interest Rates – we are in the camp that the peak on the 30-year mortgage rate already happened in October/November of 2022 when we briefly saw 7% for conforming mortgages.

5. Pricing – deal volume is incredibly slow, but prices are not collapsing. Why? New York City never experienced the dramatic rise in prices that most of the country recently enjoyed. As we have said in our last communication in December, low inventory is a major reason why we are experiencing price stability. The fear factor is miniscule.

As always, we are here to answer your real estate questions. Call or email anytime.