We’re just about reaching the peak of the spring market, which is one of the busiest seasons in Manhattan real estate. As we continue to navigate the post-Covid lockdown market, we’re still seeing a surge in demand from buyers. As mortgage interest rates continue to climb, most expect to see this surge slow down. In this week’s blog, we’re going to dig into why it’s not and what it means for you!

Manhattan real estate by the numbers

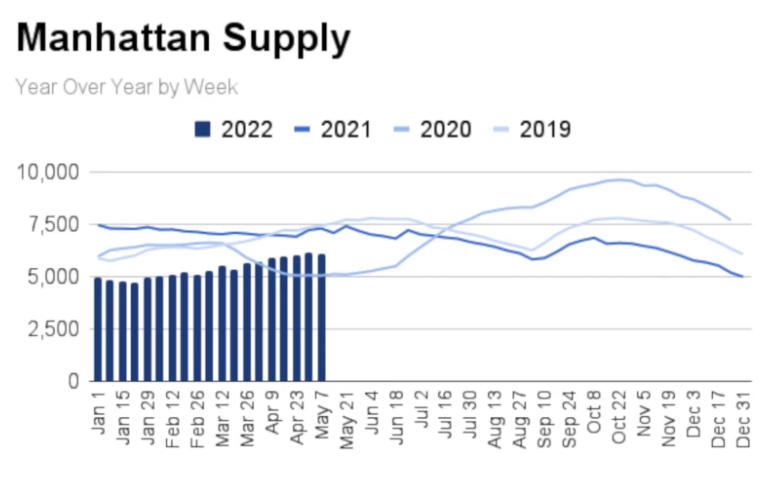

Let’s start by taking a look at the numbers. First, supply actually saw a small tick down in mid-May, after many weeks of an upward trend.

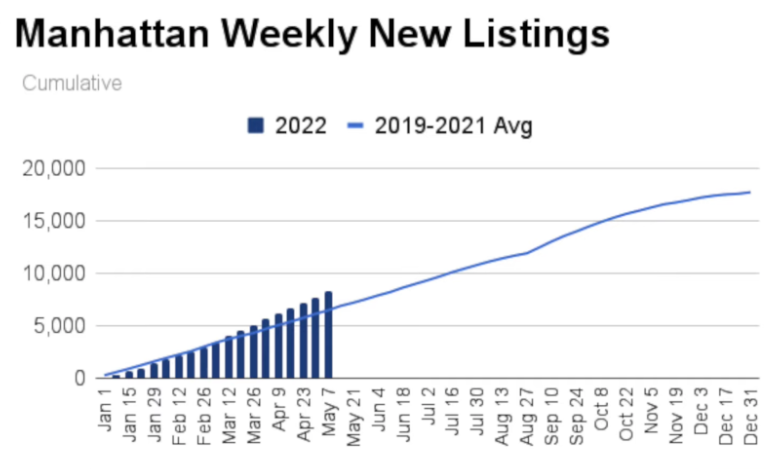

When you look at this number alongside the number of new listings, we start to see an interesting trend.

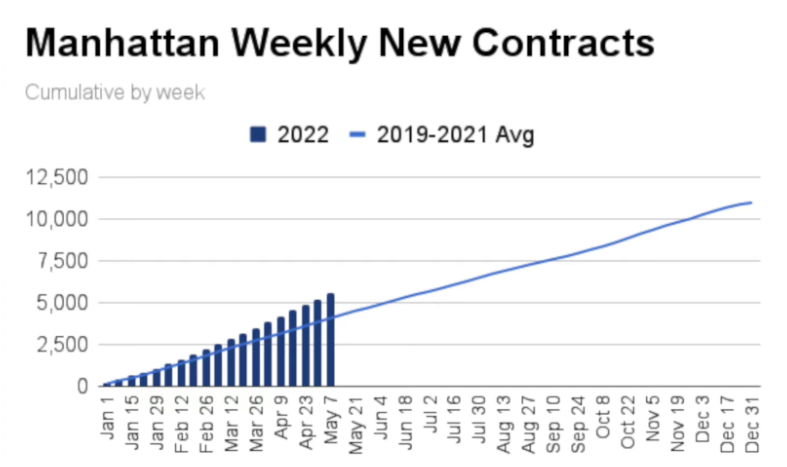

New listings continue to tick up week-over-week, as do the number of contracts signed.

This indicates that there is no shortage of new homes hitting the market, they are just not staying on the market long. Thus, why overall supply continues to tick down. The demand for these homes is still outpacing how fast they are coming on the market.

Why is demand so hot?

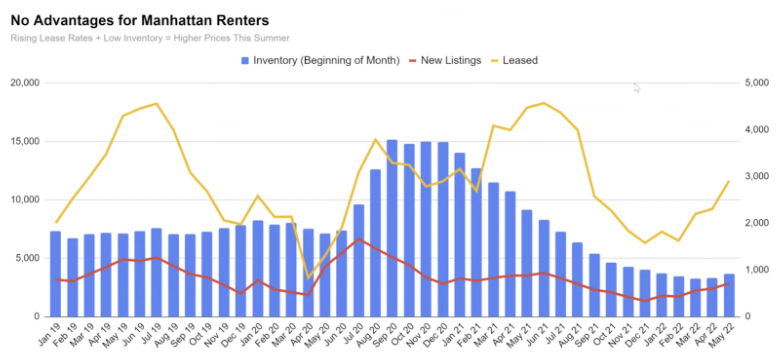

Look at the rental market!

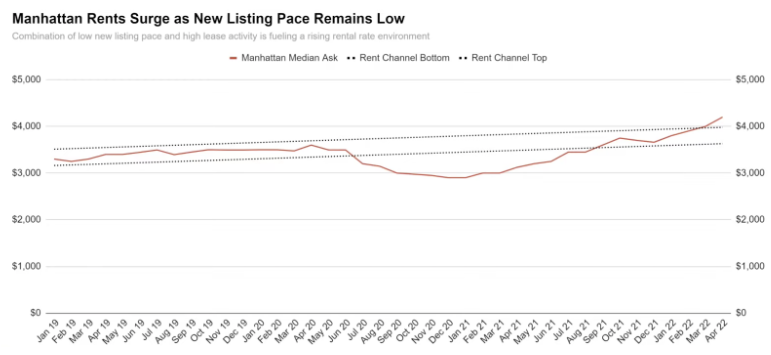

One reason for the increase in demand in Manhattan can be attributed to the rental market. During the COVID-19 lockdown in 2020 we saw rental prices plummeting, as city dwellers left Manhattan and demand fell.

However, if we look at the rental market today, we’re seeing a much different story.

The chart above shows the current inventory in the rental market. As you can see it’s incredibly low. Low inventory and rising demand are leading to what we see in the chart below, median rental prices are soaring.

This is leaving a lot of would-be renters to make the leap to buying. Even as mortgage rates continue to rise, the benefits to buying still outweigh the costs and lack of options with renting.

Other factors impacting demand

There are a few other factors that are impacting the demand in Manhattan real estate right now. One being reurbanization. As the COVID-19 lockdowns took place, we saw a surge of New Yorkers heading out of the city and into the suburbs, in search of more space. For a while now, we’ve been seeing a wave of people who left the city now wanting to come back.

Another shift in the market is wages. As the Great Resignation led to higher salaries in many industries, more people are finding they have more financial power to buy vs. rent. Again, with the rental market where it is, it makes more financial sense for many people to invest in buying despite higher mortgage rates.

How long will this demand last?

As we always say, you can’t time the market. We’re going to have to keep a close eye on these trends before we can predict when demand may fall. It’s possible that demand will remain hot through the summer months. If you’re a seller, you’ll definitely want to take advantage of demand while it’s hot. If you’re buying, even though demand is high, now may be a good time to make the financial investment in real estate if you’re on the fence about renting or facing a hike in your current rental!

As always, if you have any questions feel free to reach out to us any time.