It has been just over a year since the first Covid-19 lockdown here in New York City. It is a good time to assess where we are so we may make some educated conclusions about where we are going.

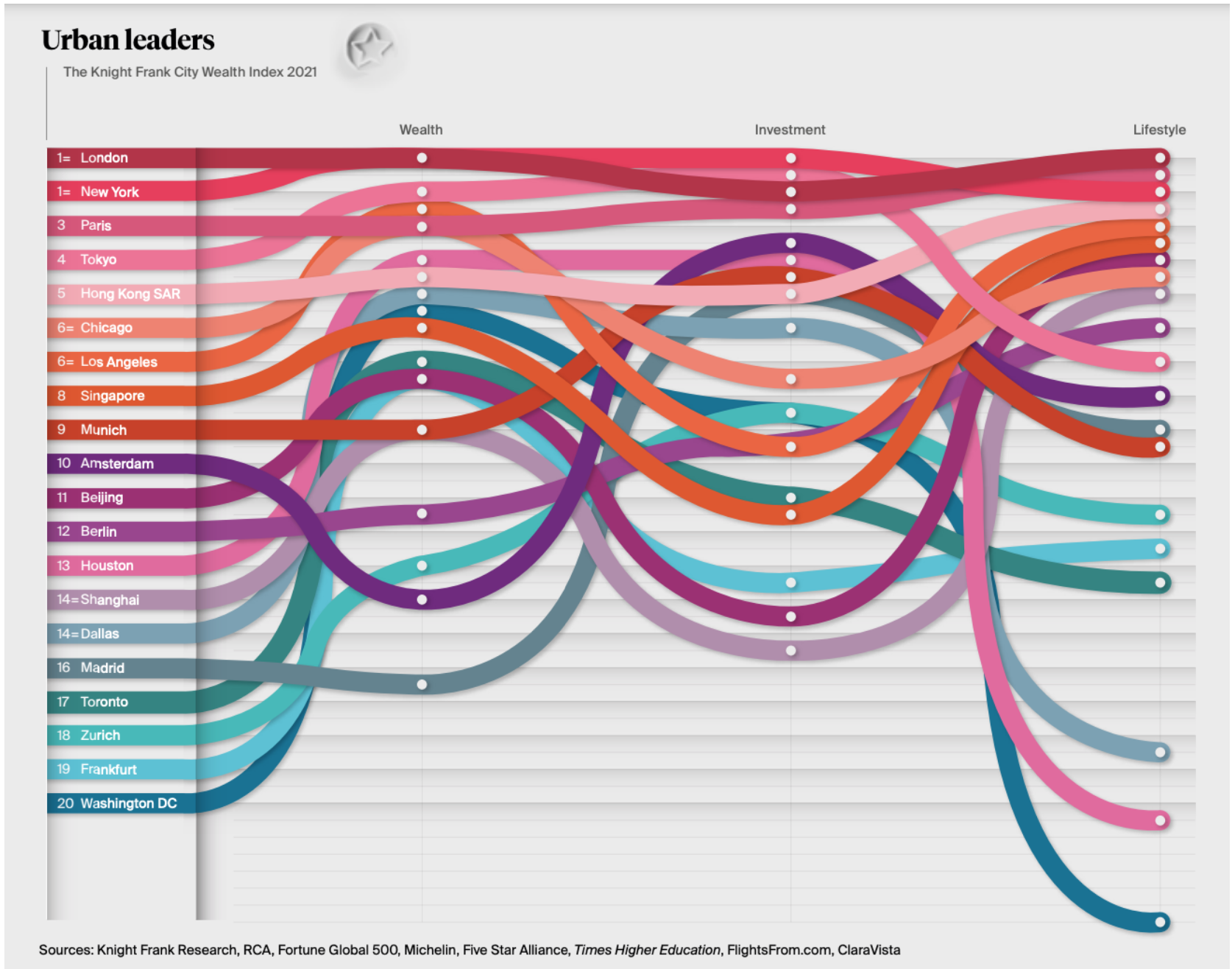

First, three interesting charts that came out of the 15th edition of Knight Frank’s Wealth Report. The first points out that New York and London are still tied for first place in the “Urban Leaders” index, with NYC #1 in wealth and investment (though taking a back seat to London and Paris in the lifestyle category).

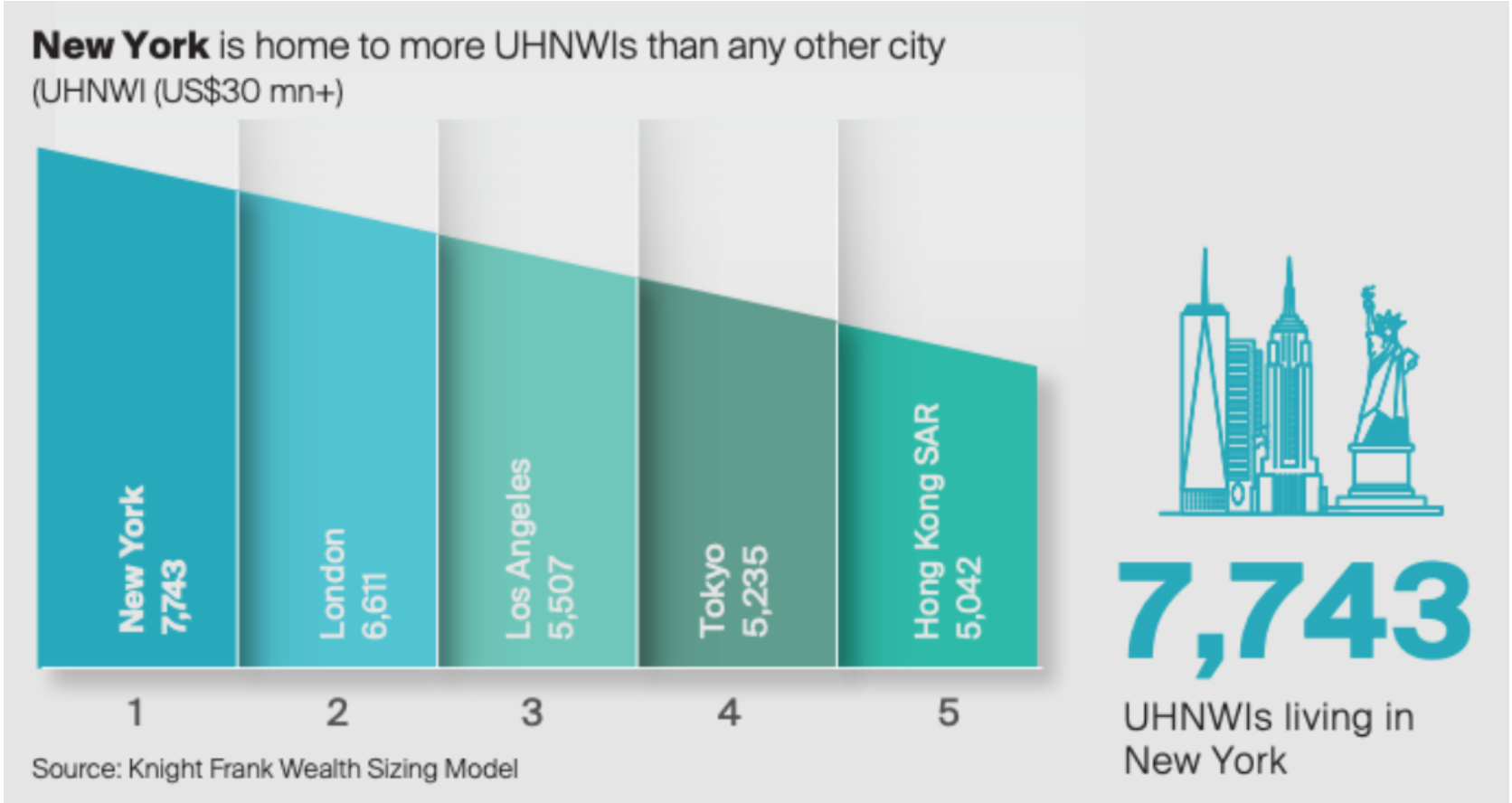

The second chart points out that NYC has more Ultra High Net Worth Individuals (UHNWIs) than any other city in the world:

The third is that demand for condos has been surgeing for the last 10 months or so:

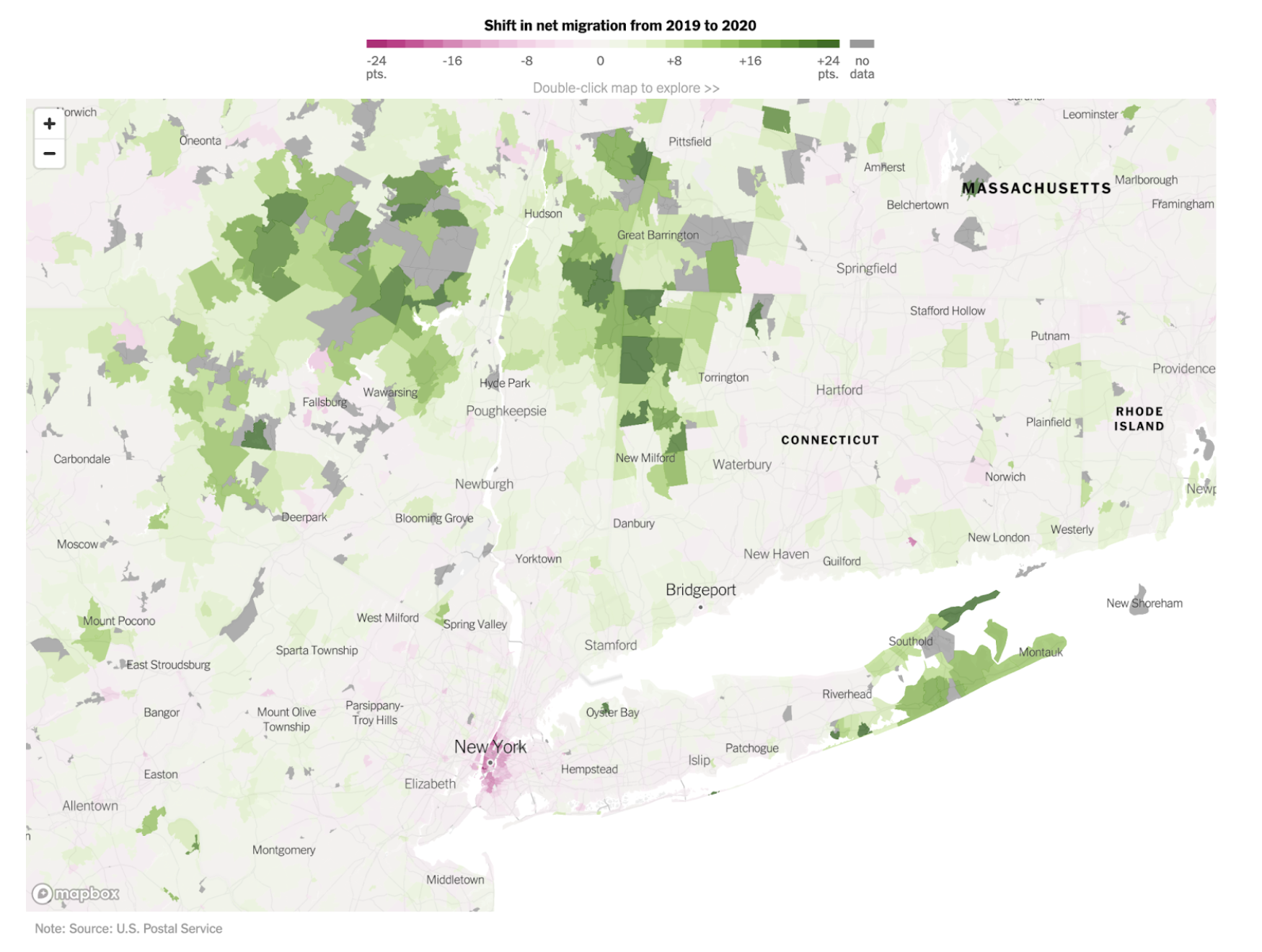

So if that’s the case, why is there a net migration out of NYC? See this data from the US Postal service?

It’s because the people who moved out were either mostly temporary (homeowners) or renters (more permanent). The mass migration out of the city, where structural, was predominantly people in the restaurant, hotel, or entertainment industries and these people were mostly renters.

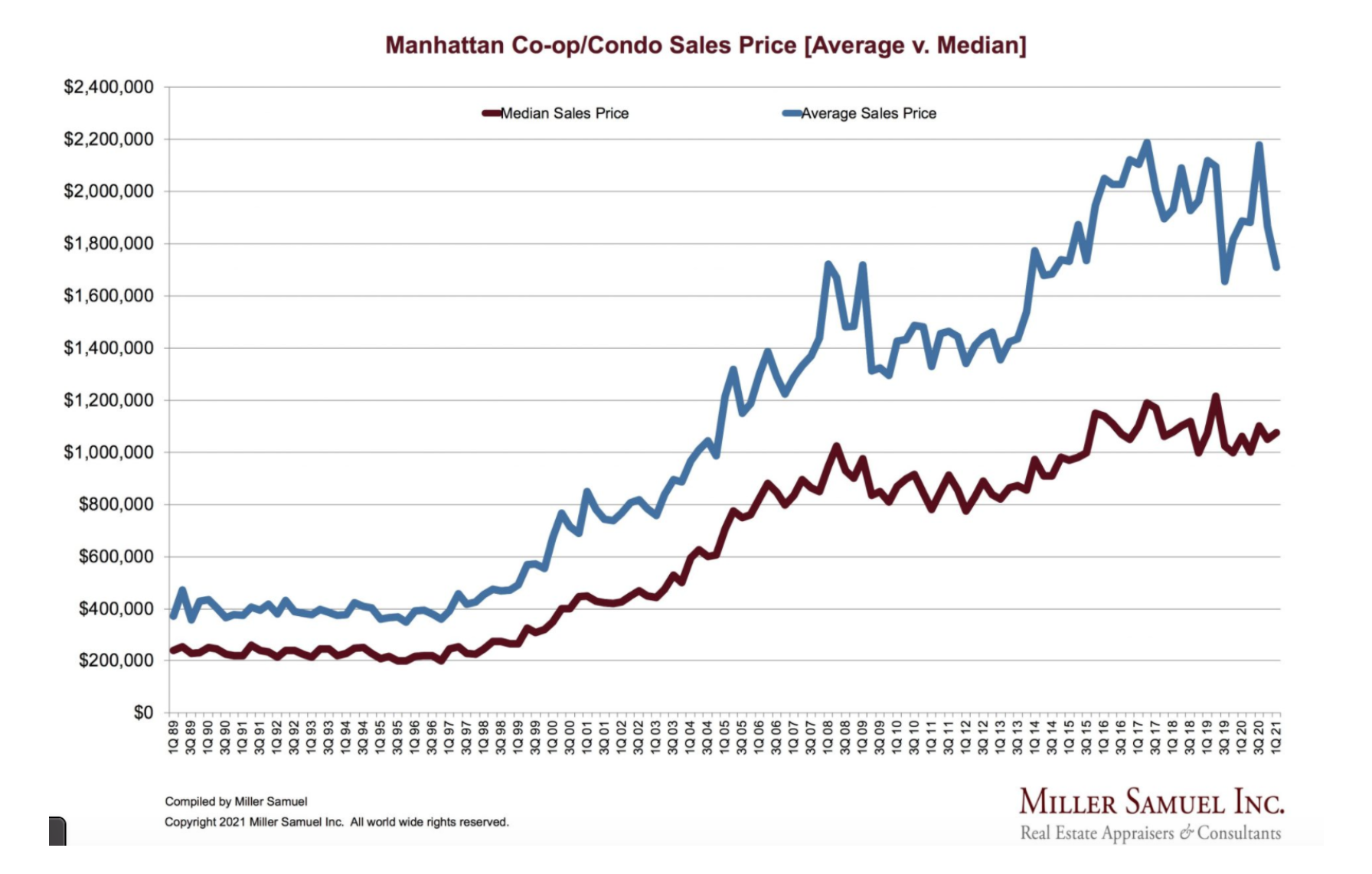

This is why the condo market has been strong. High income, white collar (think Big Tech, Wall Street, etc.) workers did not lose their jobs. And unemployment is very low amongst these people. These are the people who buy and own apartments. This is why the predicted market crash did not happen in the NYC apartment market (though it is another story altogether for NYC landlords, who are grappling with high vacancy and delinquency rates). Notice the rather conspicuous lack of a major crash in the sales market.

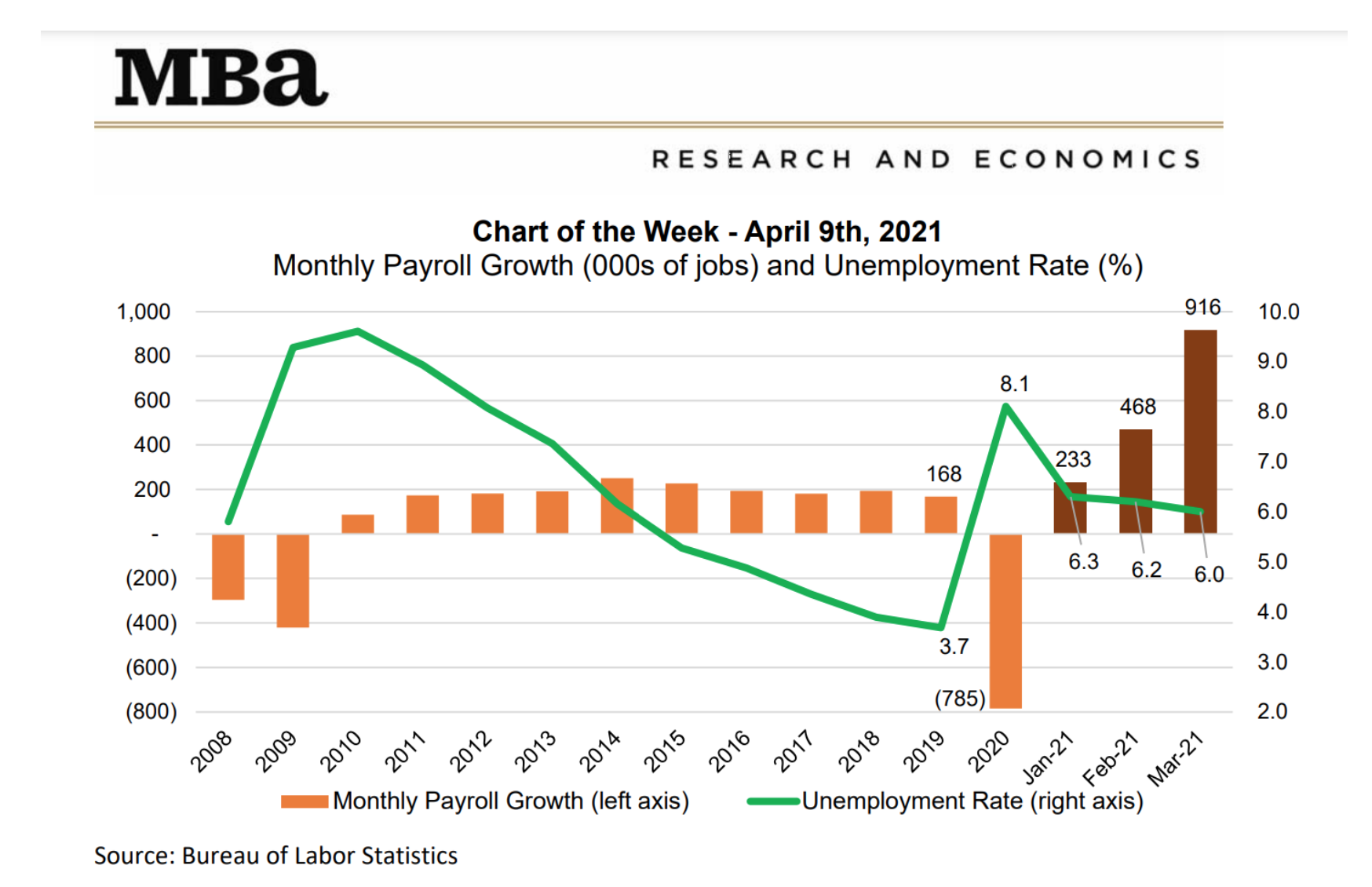

In fact the Chart of the Week from the Mortgage Bankers Association (MBA) shows how strong employment has been in the last 4 months.

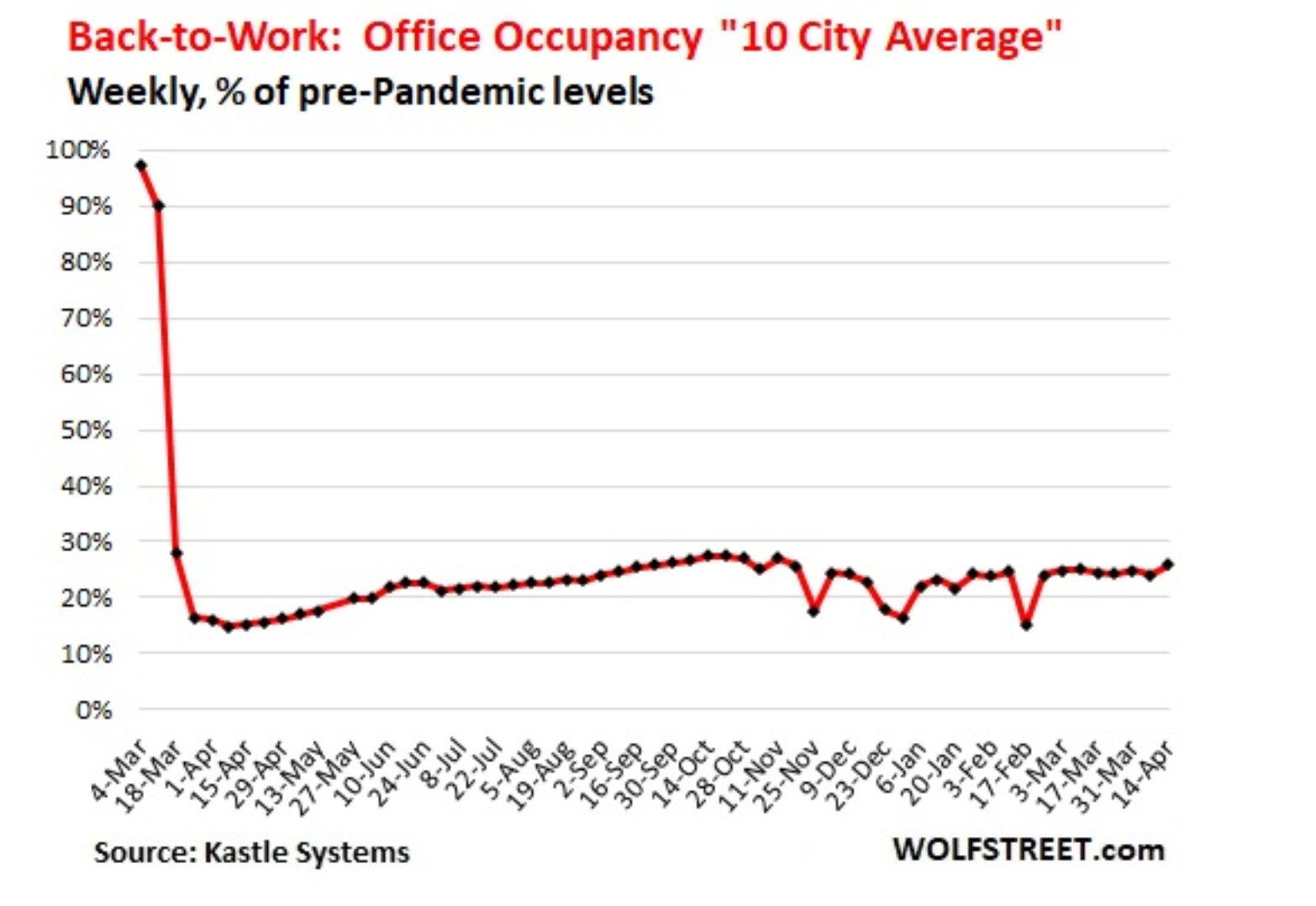

This brings us to a very New York City question, “when are all the workers coming back to the office?” Because they sure haven’t yet:

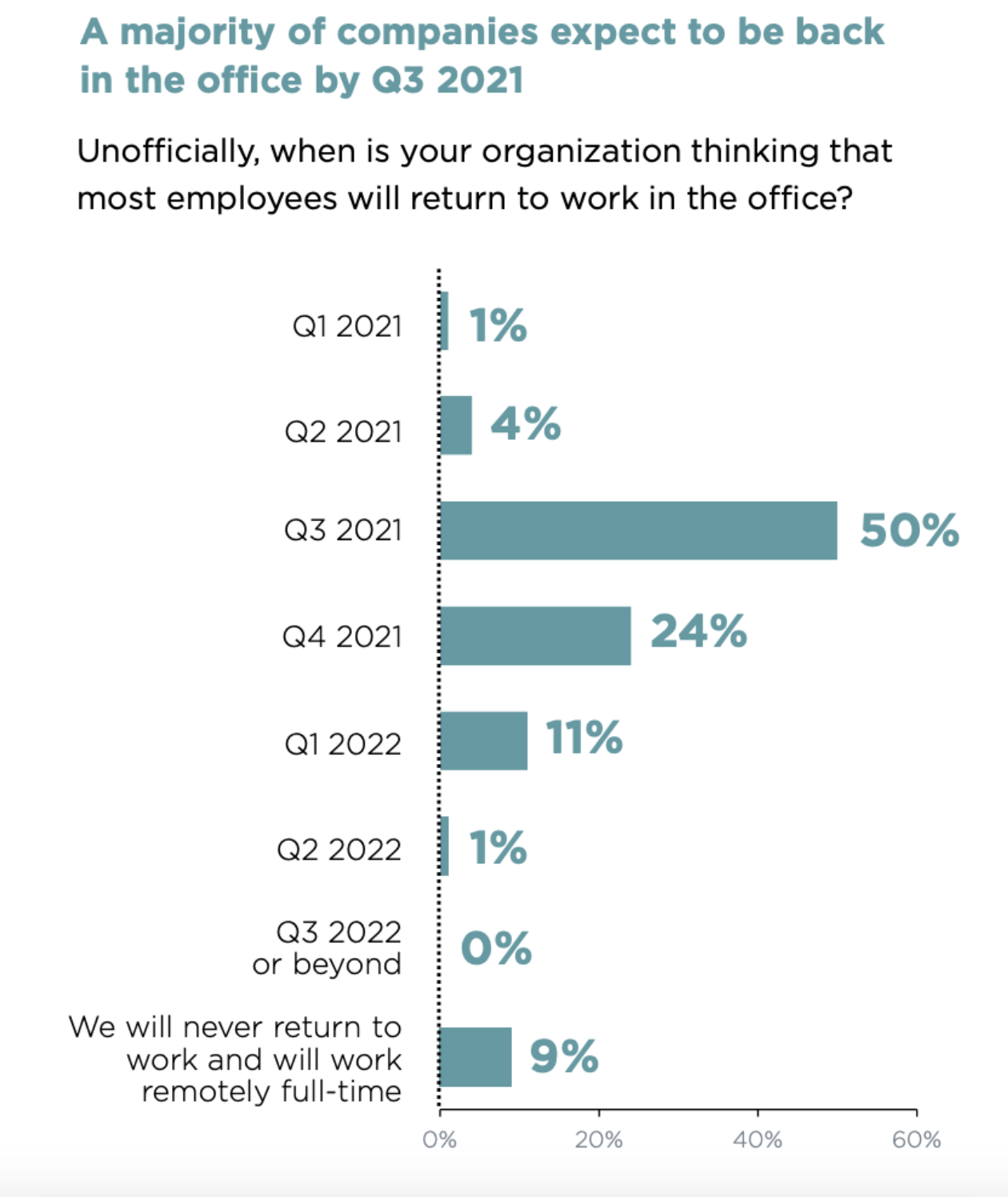

And the City needs these people back to start stabilizing the commercial real estate market. Savill’s did us a favor by doing a survey to get to the bottom of this, and here’s the punchline:

To put it another way, nearly 80 percent of respondents believe work will be mostly back in the office by the end of this year. Which will go a long way to sandbagging the beginning of another bull run in real estate here in NYC.

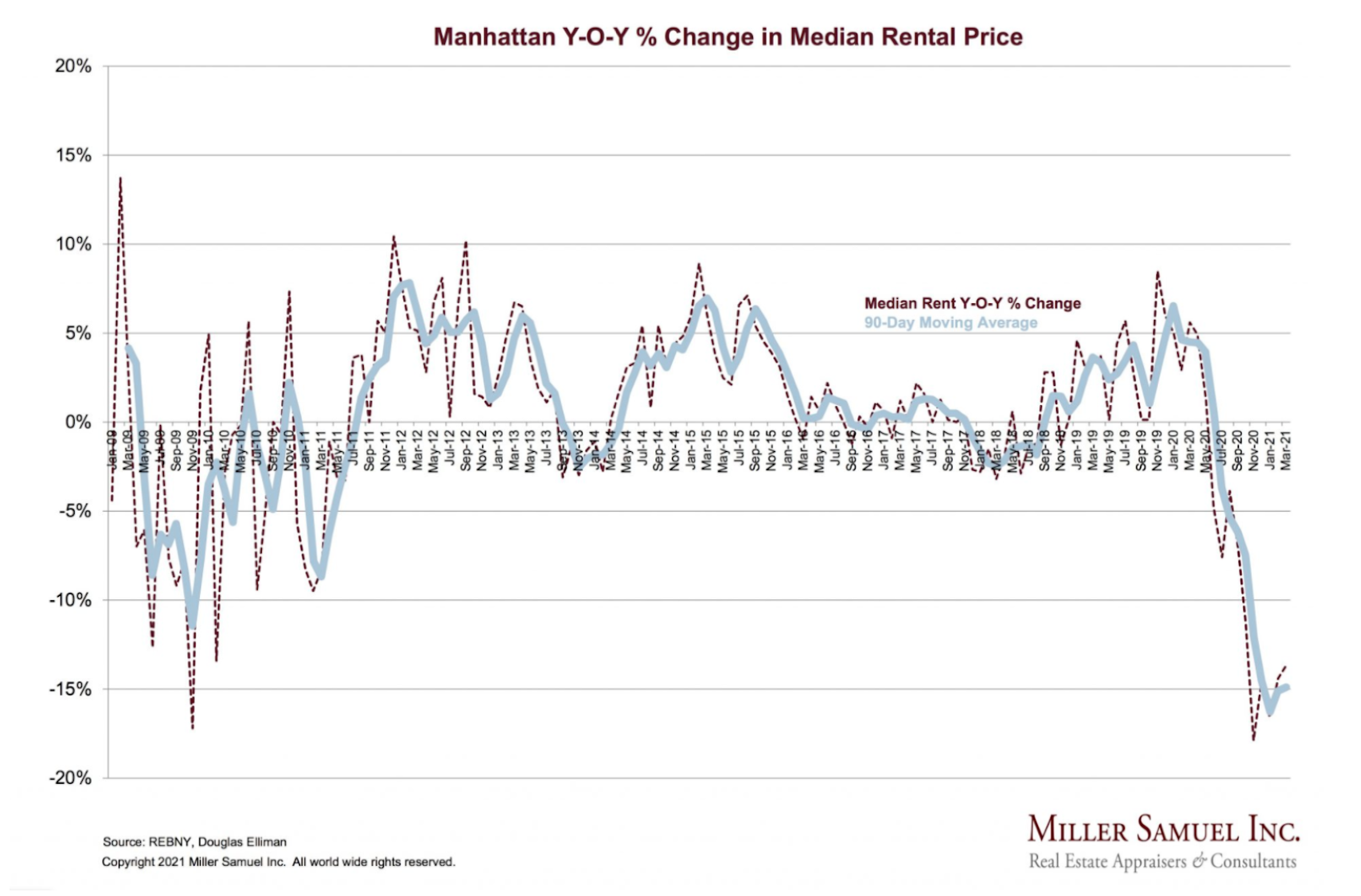

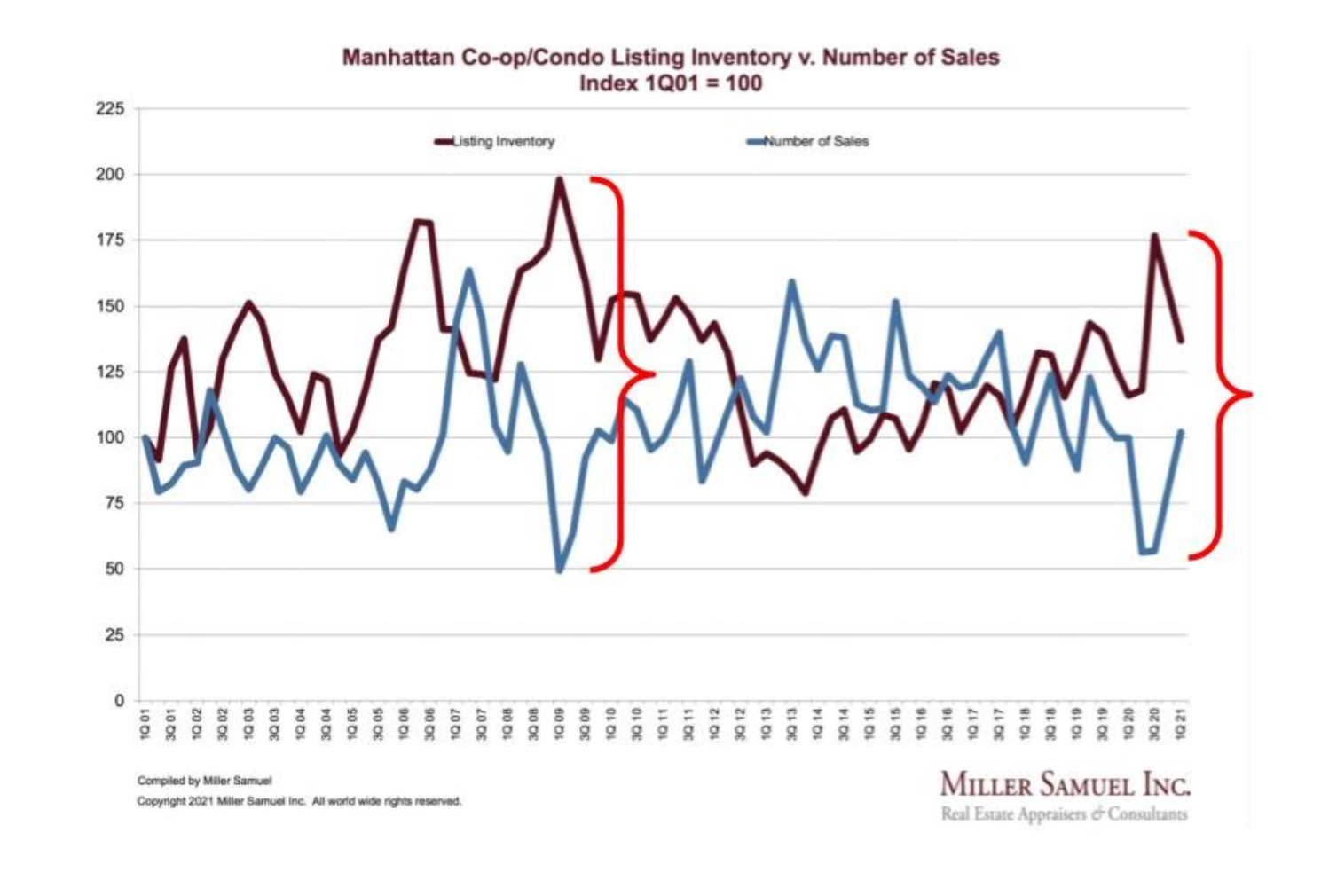

Check out this chart from Miller Samuel. It shows two major market dislocations in the last 15 years. The first one was the start of the Great Recession that was ushered in by the fall of Lehman. The second one was Coronavirus. The first thing to note is how similarly they are shaped. The second thing is that the effect of Coronavirus was much smaller than the financial crisis. Think about that!

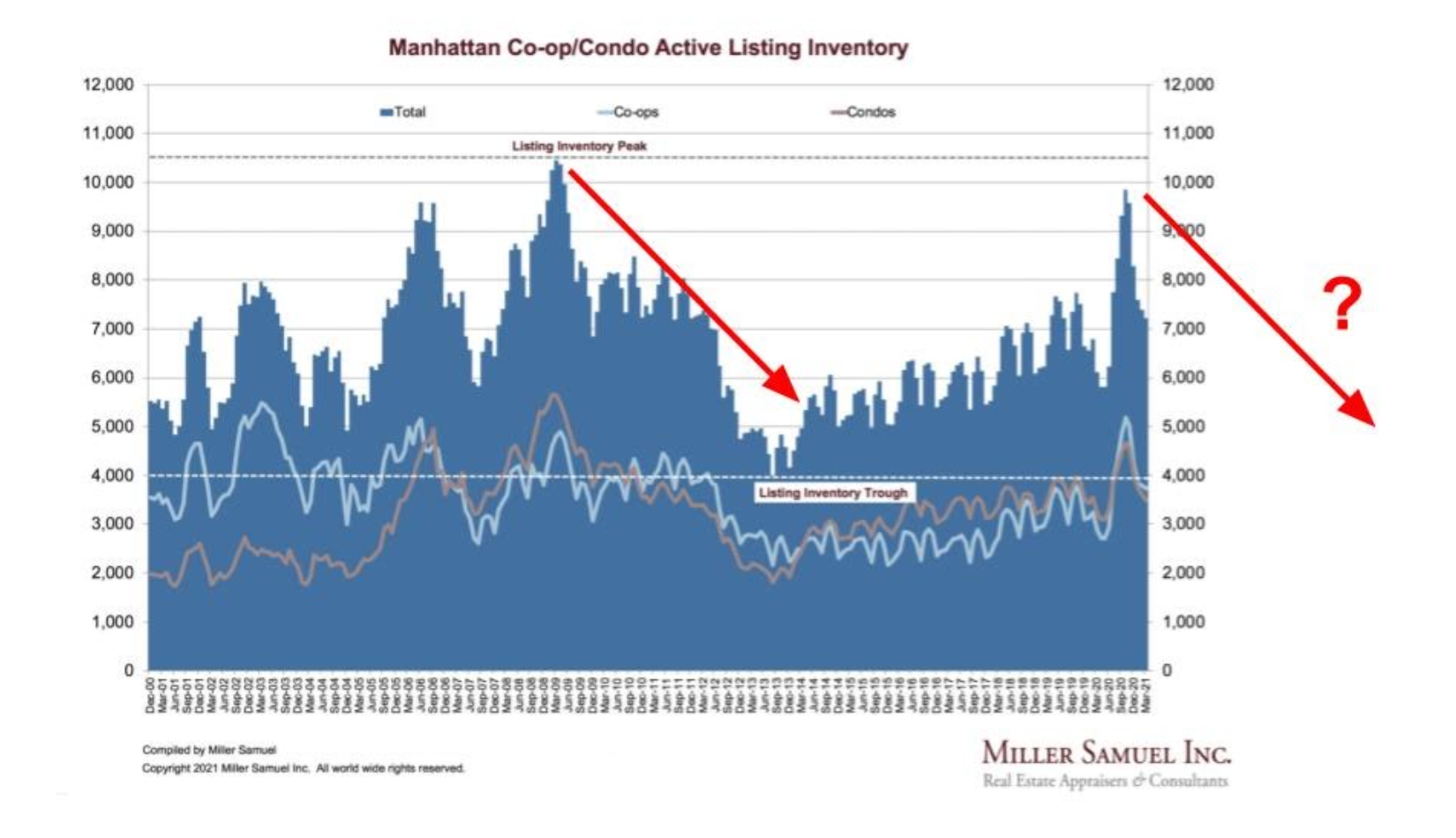

So where are we going from here? Could it be this?

We argue that it can. We have already seen the bottom of the market some months ago. When we stop to realize that:

- The high paying jobs were never at risk

- Those people are the ones that overwhelmingly buy and own properties in this town

- The extremely wealthy like being in New York

- Restaurants and theater are inevitably coming back

And lastly that Work From Home is not going on forever in its current form

It’s then that we can easily conceive of the notion that we’re at the beginning of what might be a lasting bull market in NYC.