Without a doubt, it has been a very strange year for real estate, with the COVID-19 lockdown distorting our market. That being said, it is instructive to remember that every market is just part of a cycle, and this one is no different in that regard. The shape is a little different, but the overall trends are the same. Let’s take a look and see what we can glean about the future!

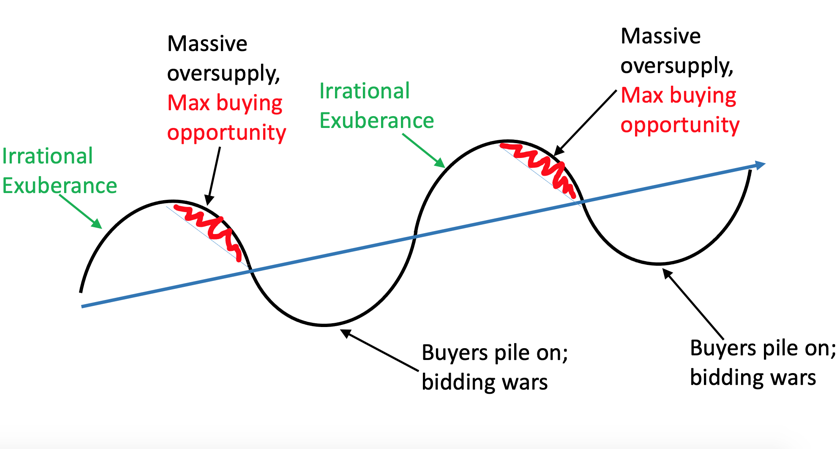

Here’s a model of the typical market cycle:

The market goes up over the long term, always, if we look back far enough. That long term trend is the blue line. In the shorter term, the market fluctuates around the trendline. That is the black sine curve. People think they want to wait for the bottom of the market because they will get the lowest prices. In reality, this is too late to buy. The maximum opportunity is before that, before everyone else piles on. In this graph, it looks like the time at the bottom is the same as every other part of the curve, but experience tells us that the bottom lasts for a nano-second. It is the bottom precisely because a huge number of buyers rush in for the best prices that the market is offering. And what happens then? Bidding wars, price increases, and guess what? Most buyers have missed it.

So where are we now? Let’s take a look at the market data.

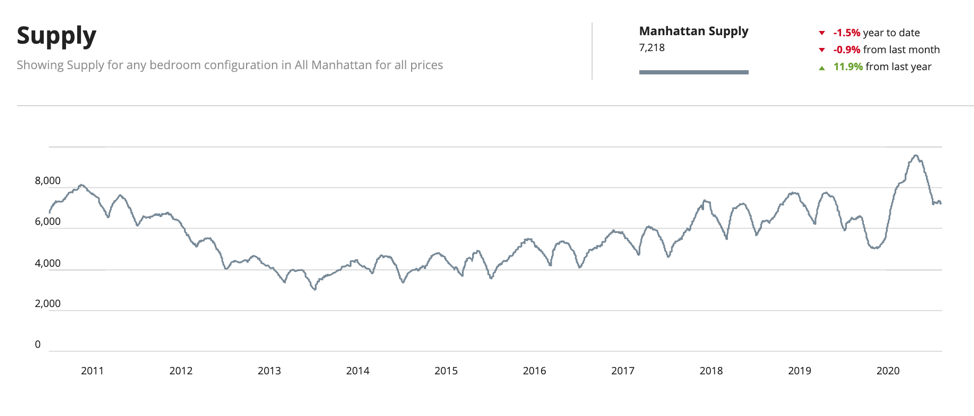

As you can see, from a supply standpoint, we are near a recent top.

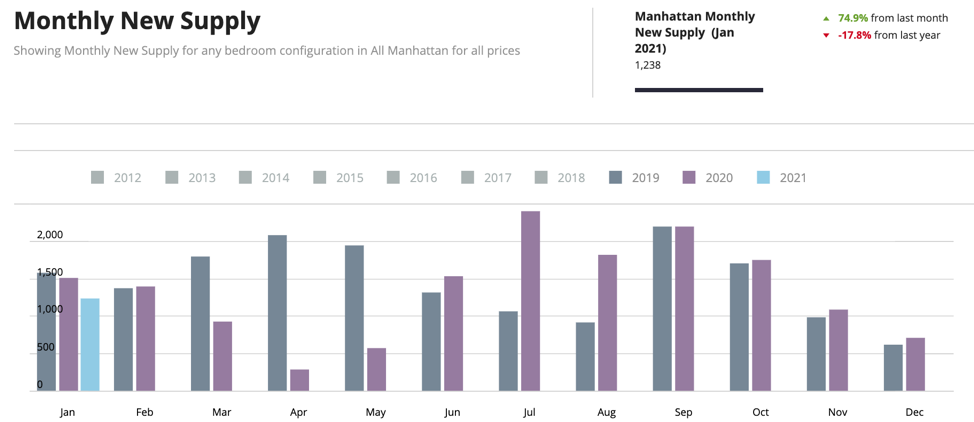

Even though there was a small fall-off in January, don’t let that fool you! Expect a lot of new supply in the months of February through April.

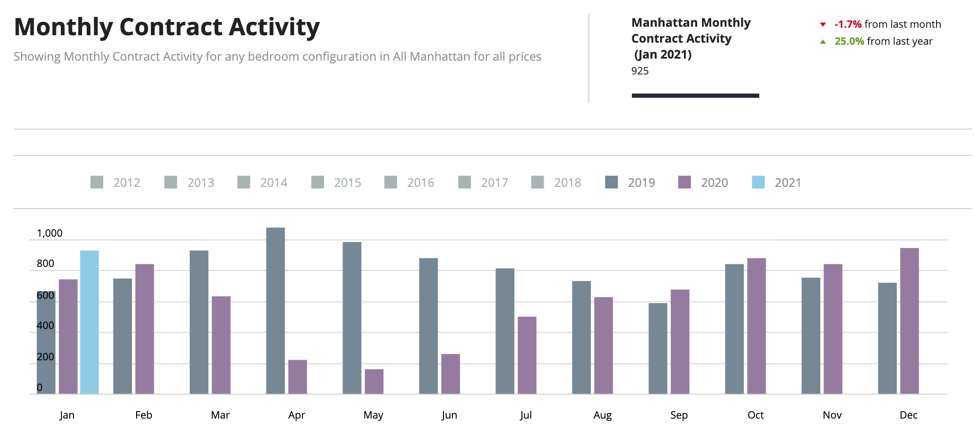

And from a demand perspective, you can see how demand was dead last year in April, May, June and July as we suffered through the Covid lockdown. But since then demand (as measured by contract activity) has been quite healthy and in fact better than the same month the year before for the last 5 months.

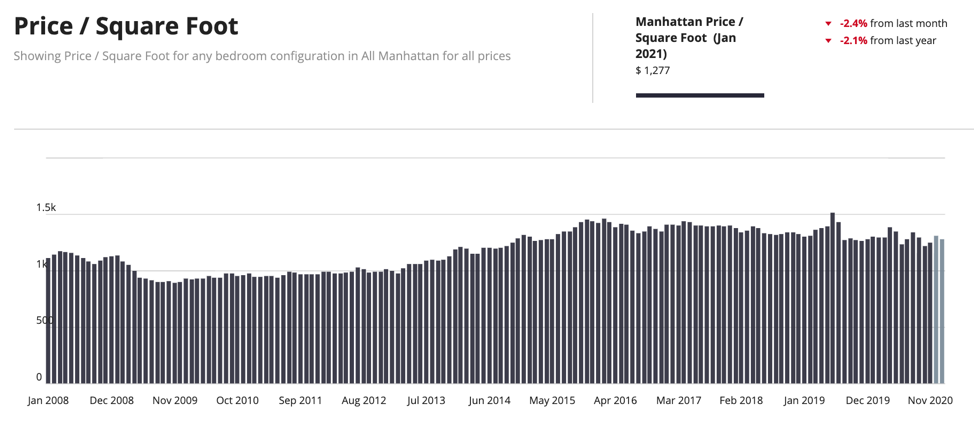

Prices are still down, though:

What should you take-away from this information?

- We are probably in the last part of the “maximum buying opportunity” (from the first graph), as demand is swelling even against the increase of supply in the last 5 months.

- Expect a vigorous market in the spring. There are already bidding wars in Brooklyn and parts of Queens.

- The first thing you will see is competitive bidding happening, but without breaking the asking prices much (e.g. a best-and-final bidding situation where the highest bid is still below the ask)

- Then you will start to see bidding wars breaking the asking prices and prices will start to rise.

- Whether this happens during the spring or fall market remains to be seen.

Here’s our advice to anyone that is considering buying or selling this year: talk to us. There is a lot going on and we are watching it very closely. You can ask us anything. One thing you can be certain of, we will always give you the straight scoop!