In the aftermath of a chaotic presidential election, it’s important to refocus on the major issues affecting the New York City real estate market.

From how the news of not one, but two promising vaccines to historically low interest rates and rock bottom rent prices, the impact of COVID-19 on New York City real estate is still here and not going away any time soon. Though there are some bright spots, it’s important we focus on all areas that are currently being impacted in the market.

1. News of a promising vaccine has a positive impact on the real estate market.

Nationally, home prices have never been higher, driven up as surging demand due to record low mortgage rates comes up against historically low inventory of homes for sale. But the most expensive urban areas have been experiencing the opposite problem. Cities like New York and San Francisco have seen higher vacancy rates and lower rents and sale prices as many people, untethered from office jobs, retreated to the suburbs and less densely populated areas. But with potential vaccines on the horizon, real estate in big cities could see a turnaround.

“It’s not going to be a light switch,” said Jonathan Miller, president of Miller Samuel, a real estate appraiser and consultant in New York City. “But the news is starting to get people to be hopeful and think about returning to the city. Because right now, without a vaccine, it is status quo.”

For those looking to buy, purchasing a home in New York will be more attractive when a vaccine makes all the things a city has to offer possible again, Miller said, including easy access to dining, theater, concerts and events. “The first thing that has to happen in terms of really accelerating the re-adoption of city life in the post-pandemic world, is going to be when companies, especially the Fortune 500 companies as leaders, start to bring people back to work,” he said.

https://www.cnn.com/2020/11/18/success/vaccine-real-estate-new-york-city/index.html

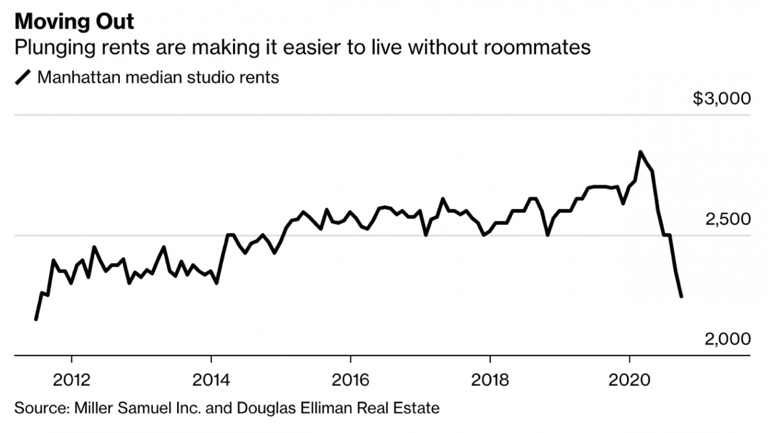

2. Rents are plummeting.

Those most affected by the coronavirus are disproportionately renters, such as those in the hospitality industry, theater, music and art worlds, etc. It is worthy of noting that the vast majority of those who moved out of the city due to Covid-19 were renters, not owners. The cheap rental rates are bringing renters back to the city for bargain basement rents, the likes of which the city has not seen in several cycles.

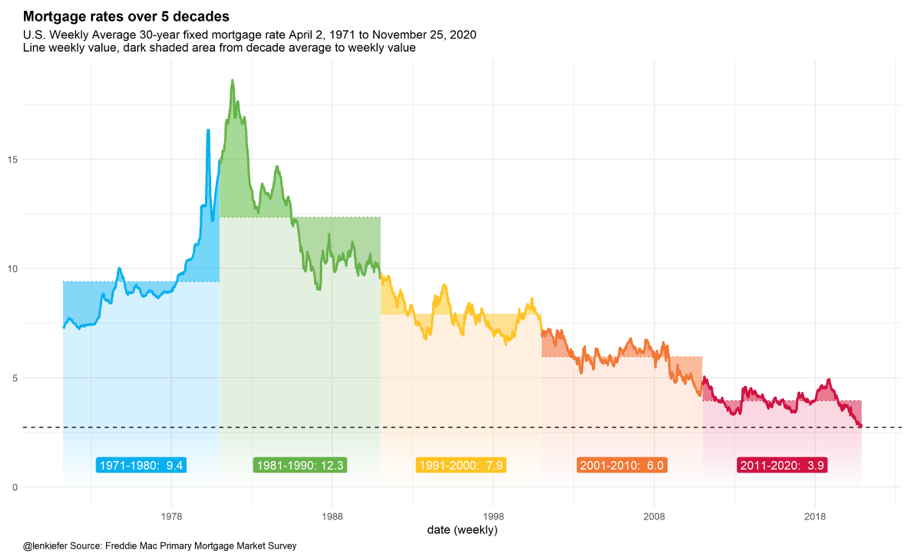

3. Interest rates are at historic lows.

This is going to keep a floor on how low prices will drop in the housing market.

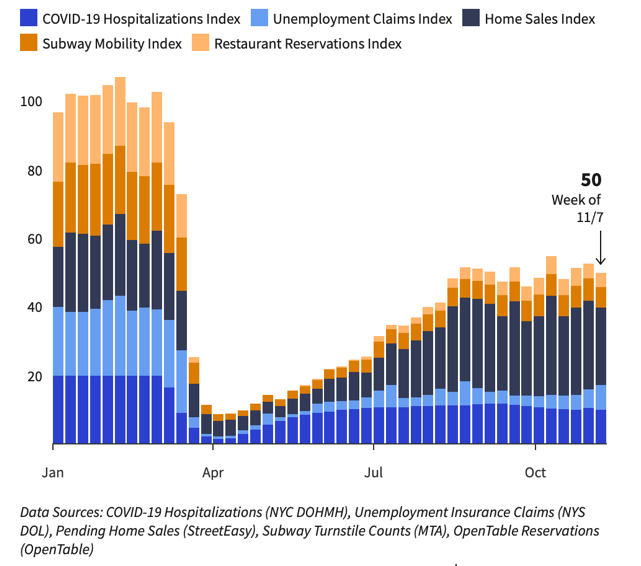

4. NYC is not out of the woods by a long shot (but there are some bright spots).

The drop in pending home sales reverses a recent trend but is likely to be a short term blip as buyers were temporarily frozen pending the presidential election results.

https://www.investopedia.com/new-york-city-recovery-index-november-16-5088766

5. Lastly conforming loan limits were raised dramatically.

For New York City, the conforming loan limits have been raised to $822,375 from $765,600 for single unit homes (apartments or single family homes). This means easier access to capital, in some cases lower rates and higher LTVs for these buyers. This will put some oomph into that price point and lower.

https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-Conforming-Loan-Limits-for-2021.aspx